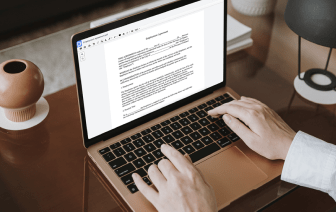

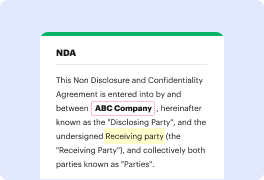

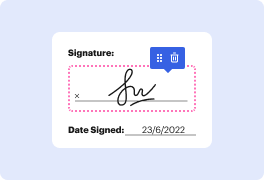

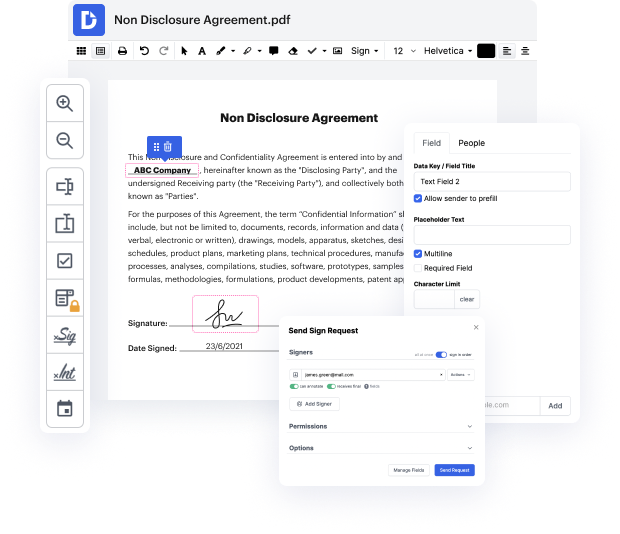

Editing text is fast and straightforward using DocHub. Skip installing software to your PC and make adjustments with our drag and drop document editor in just a few easy steps. DocHub is more than just a PDF editor. Users praise it for its convenience and robust features that you can use on desktop and mobile devices. You can annotate documents, generate fillable forms, use eSignatures, and send documents for completion to other people. All of this, combined with a competing cost, makes DocHub the ideal option to revise FATCA in text files effortlessly.

Make your next tasks even easier by converting your documents into reusable web templates. Don't worry about the protection of your data, as we securely keep them in the DocHub cloud.

okay hi this is Anthony parent of Iris medic and thank you for joining me today you know we have this curious situation where we have a lot of Americans overseas who the IRS doesnamp;#39;t believe is in tax compliance and uh the foreign account tax compliance that gave them some tools by which to compel Americans overseas and those in America with accounts overseas to bring them home to the American tax system even if theyamp;#39;re not American itamp;#39;s okay um and doing so the the IRS is sort of uh trying to to round them up to round them up to uh get all these uh Banks to do their bidding and to uh make sure that this uh noose uh gets tightened and thereamp;#39;s less wiggle room to escape to to um help the IRS in its Mission we have a curious notice that came out and itamp;#39;s IRS notice 2002 -11 and this is a session this is essentially what itamp;#39;s trying to do itamp;#39;s um itamp;#39;s encouraging U.S residents and the jurisdictions to provide their their taxpa