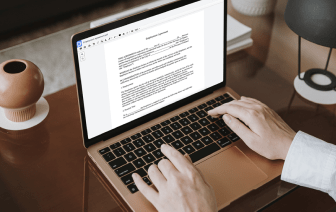

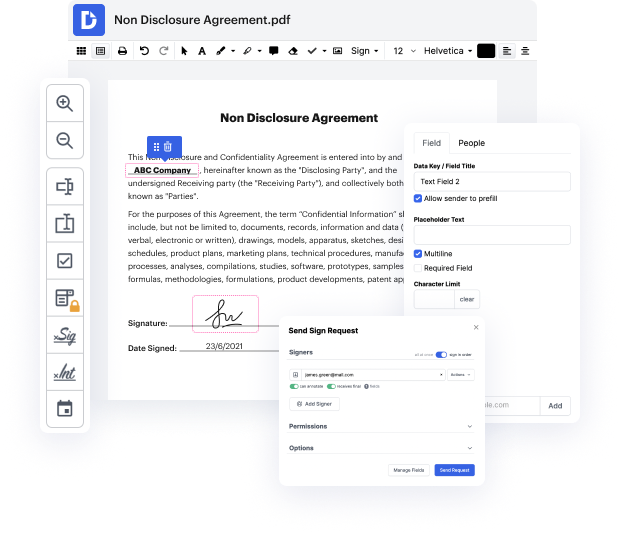

Many people find the process to revise FATCA in powerpoint quite difficult, especially if they don't frequently work with documents. Nevertheless, these days, you no longer have to suffer through long tutorials or spend hours waiting for the editing software to install. DocHub allows you to modify documents on their web browser without installing new applications. What's more, our robust service provides a full set of tools for professional document management, unlike so many other online solutions. That’s right. You no longer have to export and import your forms so frequently - you can do it all in one go!

No matter what type of document you need to modify, the process is simple. Make the most of our professional online solution with DocHub!

so what is foxconn well fatca is an act that allows two countries uh especially regarding america to share information between each other of banking accounts and other financial accounts who does it affect well anybody that has anything to do with america essentially is affected by this so us citizens anybody thatamp;#39;s resident in the united states even green card holders when they leave the united states and they still have their green card holder and it especially affects those that have dual citizenships so donamp;#39;t think that you can just use your foreign passport to open your accounts and that youamp;#39;ll be out of the way of fatca so weamp;#39;ve learned a little bit about what fatca is did it actually work well from the numbers it seems to have the irs correct collected 4.4 billion dollars in penalties from 2009 to 2011 and those were only from the voluntary uh disclosured programs they recovered 60 billion dollars through late payments from 2011 to 2013 and these