There are so many document editing tools on the market, but only a few are compatible with all file types. Some tools are, on the contrary, versatile yet burdensome to use. DocHub provides the answer to these hassles with its cloud-based editor. It offers robust functionalities that enable you to complete your document management tasks effectively. If you need to quickly Restore FATCA in DBK, DocHub is the perfect option for you!

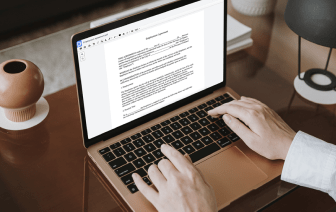

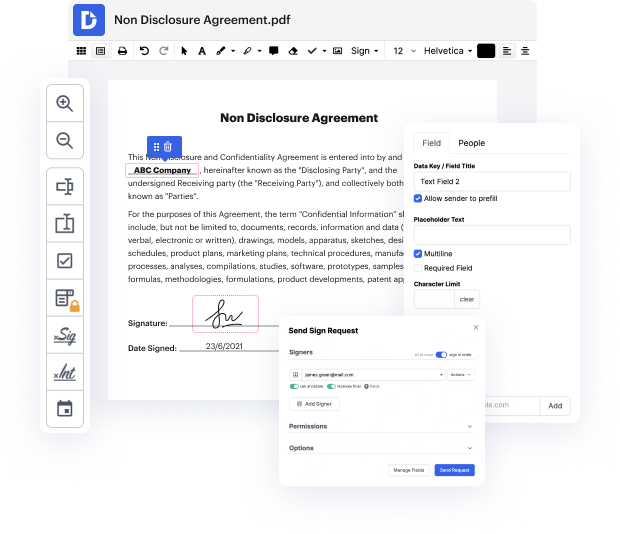

Our process is incredibly easy: you import your DBK file to our editor → it instantly transforms it to an editable format → you make all essential adjustments and professionally update it. You only need a few minutes to get your paperwork done.

When all modifications are applied, you can transform your paperwork into a reusable template. You just need to go to our editor’s left-side Menu and click on Actions → Convert to Template. You’ll find your paperwork stored in a separate folder in your Dashboard, saving you time the next time you need the same form. Try out DocHub today!

A new sensation from the USA: FATCA But what is this exactly? No, not exactly. FATCA is actually a US law and means Foreign Account Tax Compliance Act. Its really not as complicated as it seems. Basically just like many other countries, the USA is dealing with a huge budget deficit. Thats why the USA needs money. And what are the possible sources of a income for a country like this? Thats right. One possibility is tax it. In the past, the USA didnt take full advantage of this possibility. After all, every US citizen who lives abroad actually has to pay taxes in the USA, but only a few really do so. This means the United States are losing a lot of money. Thats why the US government past the new FATCA law. Foreign banks such as banks in Germany are now supposed to identify which of their customers are US citizens. Private customers as well as corporate customers. Even all shareholders who are US citizens and hold more than 25 percent of a company are affected. The banks then send