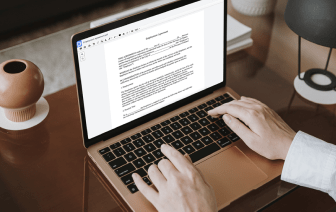

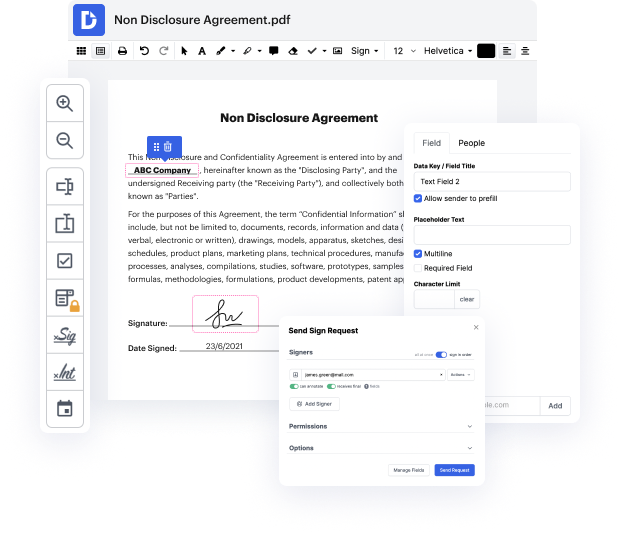

Time is a crucial resource that every company treasures and attempts to turn into a advantage. In choosing document management software, be aware of a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge tools to improve your file management and transforms your PDF editing into a matter of one click. Replace Payment Field into the Notice Of Credit Limit Increase with DocHub in order to save a ton of time and increase your efficiency.

Make PDF editing an simple and easy intuitive process that will save you plenty of valuable time. Effortlessly change your documents and give them for signing without the need of adopting third-party solutions. Concentrate on relevant tasks and improve your file management with DocHub starting today.

in the past if you wanted to increase your credit limit with your Chase credit card you had to request it online through the computer or on the phone with a representative but when you did this Chase would do a hard pool on your credit which can hurt your credit score by a few points the reason that your score decreases is because of a hard inquiry that has shown up on your credit report in my opinion this has discouraged many people from applying for a Chase credit limit increase to avoid a hard pool and asking for an increase at a hard pool is kind of pointless many would rather apply for a new card but considering that many banks and Credit Unions offer credit limit increases at soft pools its great that Chase is doing the same this is an excellent way to encourage more people into the chase ecosystem and utilize their Chase credit cards more unfortunately the credit limit increase option through the app is only available for Chase personal credit cards but not business but hopeful