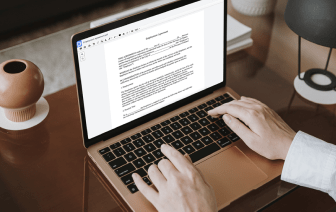

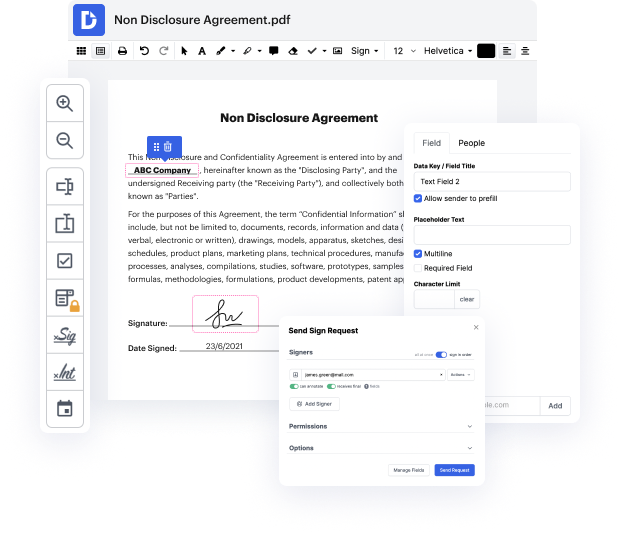

Time is a crucial resource that every business treasures and tries to transform into a advantage. When selecting document management application, focus on a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge tools to improve your file administration and transforms your PDF editing into a matter of one click. Replace Dropdown from the Plan Of Dissolution with DocHub in order to save a lot of efforts and boost your efficiency.

Make PDF editing an simple and intuitive operation that helps save you a lot of valuable time. Easily modify your documents and give them for signing without having looking at third-party software. Give attention to pertinent tasks and boost your file administration with DocHub right now.

going over IRS form 966 corporate dissolution or liquidation as required under section 6043-a of the Internal Revenue code who must file this tax form a corporation or a farmers Cooperative must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock exempt organizations and qualified subchapter S subsidiaries should not file form 966. exempt organizations should see the struct instructions for form 990 return of organization exempt from income tax or form 990 PF return of private Foundation or section 4947 A1 trust treated as private Foundation sub chapter S subsidiaries should see form 8869 qualified subchapter S subsidiary election did not file form 966 for a deemed liquidation such as a section 338 election or an election to be treated as a disregarded entity under Treasury regulations Section 301 decimal 7701-3 you should file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate