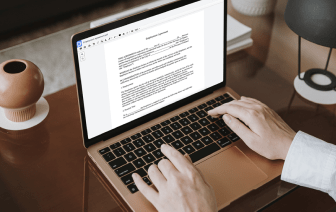

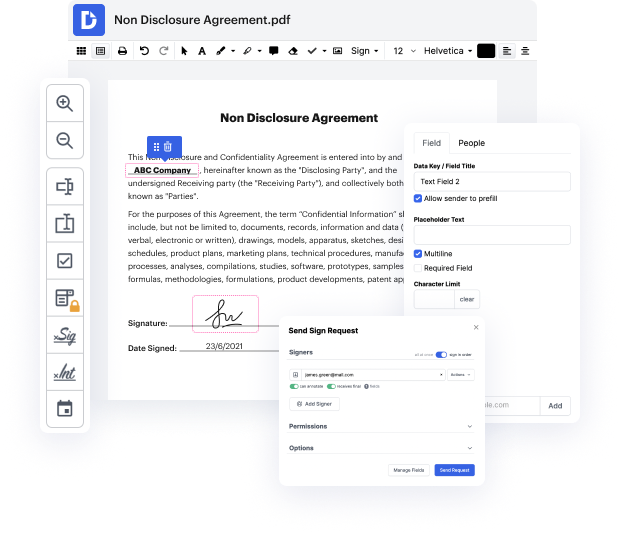

Time is a vital resource that every business treasures and attempts to turn in a gain. In choosing document management application, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge tools to optimize your file administration and transforms your PDF file editing into a matter of a single click. Replace Data into the Business Credit Application with DocHub to save a ton of time and improve your efficiency.

Make PDF file editing an simple and intuitive operation that helps save you plenty of valuable time. Quickly adjust your documents and give them for signing without adopting third-party options. Give attention to relevant duties and increase your file administration with DocHub starting today.

what you need to put on your business credit application to get approved number one some people feel like they have to put the current revenue of what their business has made but on most business credit applications you can put your projected Revenue meaning you havent received this money yet or you have not actually sold this Goods or whatever your services are yet but you project that you will so if thats fifty thousand dollars or sixty thousand dollars you can put that on your credit application number two you want to be sure that the information on your business credit application matches what you havent done in Bradstreet and matches what you have registered with your state as well as with the federal government make sure that the the name matches and that the address matches so that they can recognize that this is the same business some people get denied simply because they dont have the correct address they dont have the correct business name or they dont have the correct