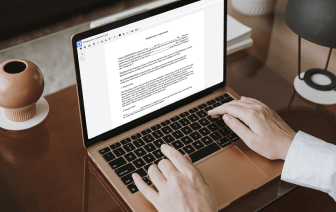

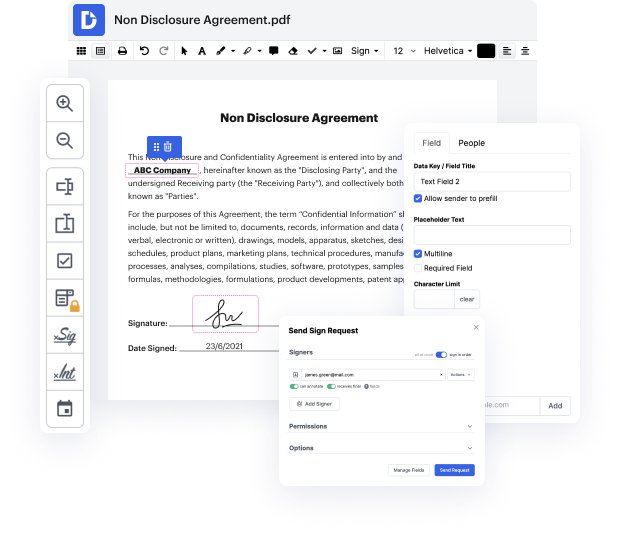

Time is a crucial resource that every company treasures and tries to change into a gain. When selecting document management software program, be aware of a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge tools to maximize your document administration and transforms your PDF file editing into a matter of one click. Replace Checkmark from the Plan Of Dissolution with DocHub to save a lot of efforts and increase your productiveness.

Make PDF file editing an simple and intuitive process that will save you a lot of precious time. Easily change your documents and give them for signing without the need of adopting third-party software. Focus on pertinent tasks and increase your document administration with DocHub starting today.

hey there youtube so in this video i wanted to cover the irs form 966 this is the form for corporate dissolutions or liquidations so if you have a us corporation so this is a lets say a regular corporation for-profit corporation informed under state law or if you have an llc that filed an election to be taxed as a c-corp if you close down that entity you will need to file this form 966 within 30 days after you adopt a plan or resolution to close down the company so i want to run through the form the various elements and the things you need to include with it just to make sure youre doing this as correctly as possible so the top of the form is relatively straightforward right we have the name of the corporation uh here obviously ive got a company delaware company inc not a real business so dont use this uh the mailing address for the company the ein for the company and the type of return were filing right so this is a standard c corp return so 1120 if you have an s corporation th