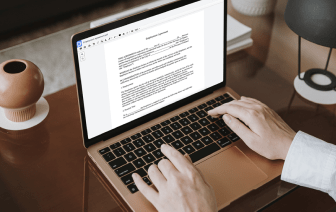

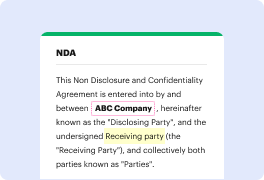

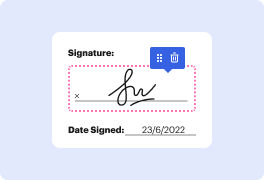

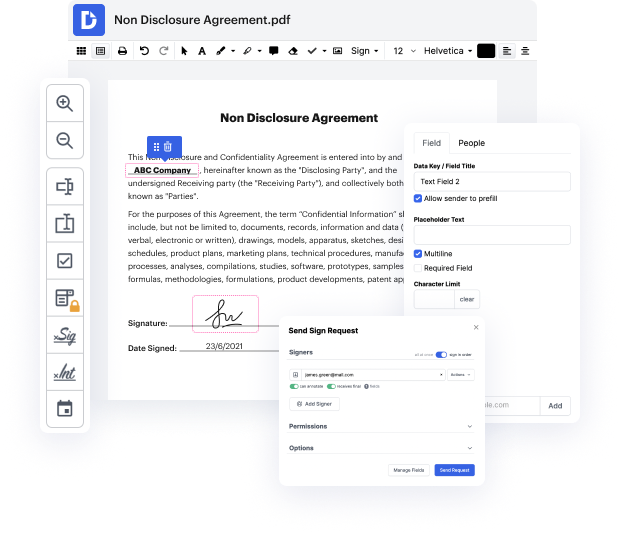

Time is a vital resource that each business treasures and attempts to transform in a gain. When selecting document management software program, be aware of a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge features to optimize your document administration and transforms your PDF file editing into a matter of one click. Replace Checkbox Group from the Share Repurchase Agreement with DocHub in order to save a lot of efforts and boost your productiveness.

Make PDF file editing an simple and easy intuitive process that will save you a lot of precious time. Effortlessly change your documents and send them for signing without the need of looking at third-party software. Concentrate on relevant tasks and boost your document administration with DocHub starting today.

hi this is David a banach turtle with a quick review of a repurchase agreement or whats called a repo transaction now its just a secured loan so if we start here with the borrower also called the buyer and the repo or the one whos doing the repo then our borrower here is selling the collateral so this could be a bond to the lender the lender is also called the seller and the repo or the one whos doing the reverse repo so the borrower selling the collateral to the lender in exchange for cash so my simple example the collateral has a value of $100 here and so our borrowers borrowing $100 against this collateral and now heres the key thing our borrower is promising to repurchase or buy that collateral back in the near future as soon as tomorrow probably so if theyre selling that a spot price here theyre really locking in a forward price tomorrow and so if we skip forward one day this is tomorrow then our borrower here repurchases the collateral by paying the locked-in forward price