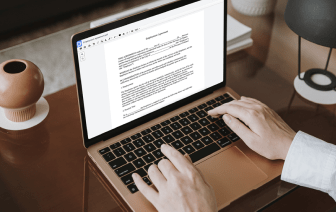

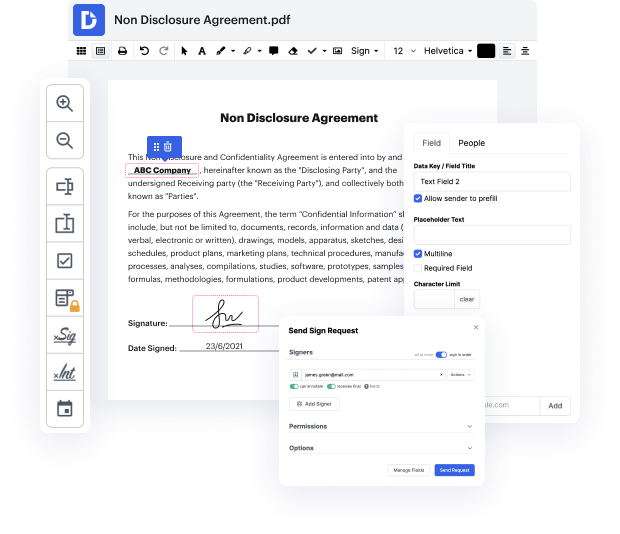

Time is a crucial resource that each organization treasures and tries to convert in a advantage. When picking document management application, pay attention to a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge tools to maximize your file management and transforms your PDF editing into a matter of one click. Replace Checkbox from the Mortgage Agreement with DocHub in order to save a lot of time and boost your efficiency.

Make PDF editing an simple and intuitive process that will save you a lot of valuable time. Effortlessly alter your documents and send them for signing without the need of adopting third-party software. Focus on relevant tasks and enhance your file management with DocHub starting today.

[Music] another good example of how utterly complicated the mortgage business is right now is what I call the story of the mist check box there was a loan application that when we submitted it to the bank for loan approval came back rejected they had rejected my clients loan and of course I was very concerned and I couldnt tell what the problem was there was good credit there was a good down payment there was a high credit score I couldnt quite figure it out on my own I called the underwriter and the underwriters said on the Good Faith Estimate you missed a checkbox and I was confused and it turns out that the underwriter was correct theres a question on the Good Faith Estimate that pertains to escrows for property taxes and homeowners insurance and does the consumer accept escrows on this loan yes or no where that checkbox was missed and theyve rejected the loan for a simple checkbox for which you think they would just say could you have your client check this box and initial it t