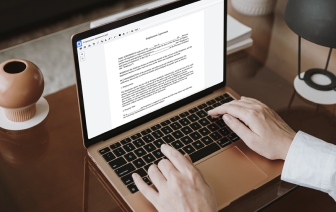

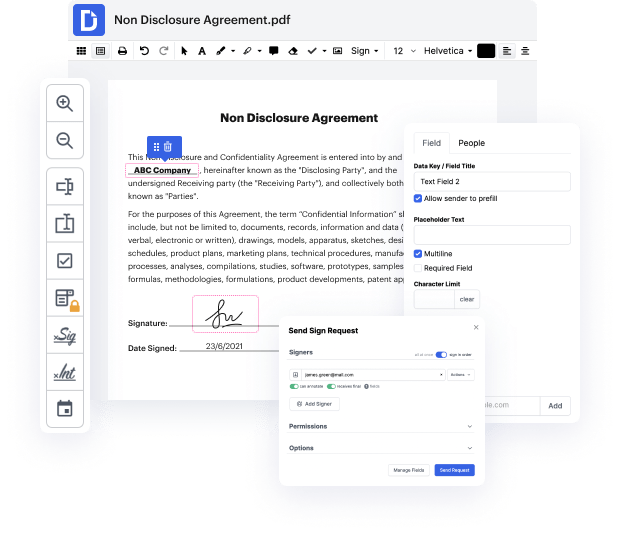

Time is an important resource that each company treasures and attempts to turn into a benefit. In choosing document management software, take note of a clutterless and user-friendly interface that empowers consumers. DocHub gives cutting-edge tools to maximize your document administration and transforms your PDF file editing into a matter of a single click. Replace Calculations into the Letter Bankruptcy Inquiry with DocHub in order to save a lot of time and boost your productiveness.

Make PDF file editing an simple and intuitive operation that saves you a lot of valuable time. Quickly alter your files and send them for signing without switching to third-party alternatives. Give attention to pertinent tasks and increase your document administration with DocHub today.

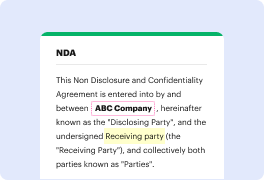

hey whats up youtube fam brandon weaver here once again were talking about removing multiple bankruptcies were talking about removing repossessions lets get into it right now i had an individual right and they said hey look i got a chapter seven got a chapter 13 but chapter 13 was dismissed okay so how do i handle this with the dismissed bankruptcy and also dealing with this chapter seven so youve got this discharge youve got a dismissed one so first and foremost you can use the dismissed bankruptcy dispute letters along with your 609 dispute letters you probably want to start with that one because the dismissed bankruptcy no longer exists in the asset law right here in the letter it even says in any case because it talks about many different things and different statuses of fair credit reporting and then goes down a little further and it says in any case whether it be civil or otherwise once dismissed it no longer exists in the odds of the law right its no longer considered to