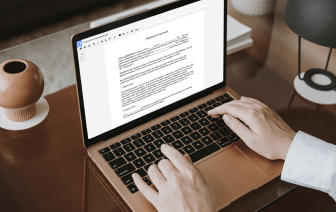

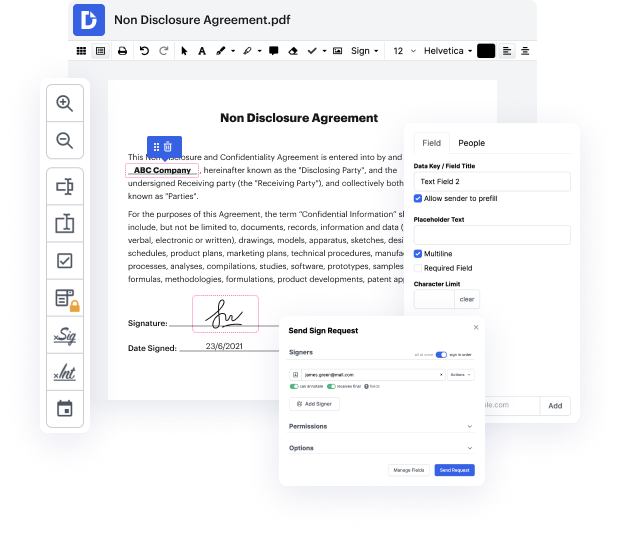

Need to rapidly replace background in Independent Contractor Agreement? Look no further - DocHub provides the answer! You can get the work done fast without downloading and installing any application. Whether you use it on your mobile phone or desktop browser, DocHub allows you to modify Independent Contractor Agreement anytime, at any place. Our feature-rich solution comes with basic and advanced editing, annotating, and security features, ideal for individuals and small companies. We offer plenty of tutorials and guides to make your first experience effective. Here's an example of one!

You don't need to worry about data safety when it comes to Independent Contractor Agreement editing. We offer such protection options to keep your sensitive data safe and secure as folder encryption, dual-factor authentication, and Audit Trail, the latter of which monitors all your actions in your document.

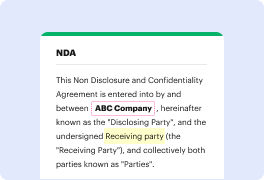

An independent contractor agreement allows a client to hire a contractor for specific jobs and is often referred to as a 1099 agreement due to the IRS form required for independent contractors. Unlike employees, independent contractors do not have taxes automatically deducted from their payments and must handle their own tax payments. This agreement highlights key legal distinctions between independent contractors and employees, with contracting offering more flexibility but less stability. The growth of independent contractor positions has outpaced the overall workforce in recent years, largely due to advancements in technology. Employers and workers should carefully evaluate various factors before creating an independent contractor agreement.