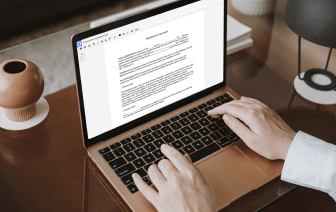

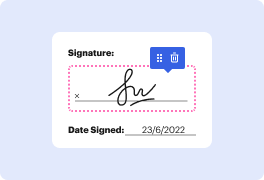

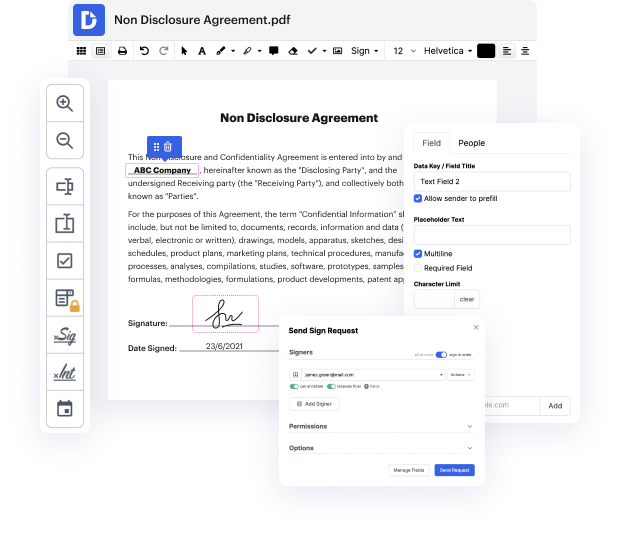

Handling and executing paperwork can be cumbersome, but it doesn’t have to be. No matter if you need assistance everyday or only occasionally, DocHub is here to supply your document-based tasks with an extra performance boost. Edit, leave notes, fill out, sign, and collaborate on your Forbearance Agreement Template rapidly and effortlessly. You can modify text and pictures, build forms from scratch or pre-built templates, and add eSignatures. Owing to our top-notch safety precautions, all your data stays safe and encrypted.

DocHub provides a complete set of features to streamline your paper workflows. You can use our solution on multiple devices to access your work wherever and whenever. Improve your editing experience and save hours of handiwork with DocHub. Try it for free today!

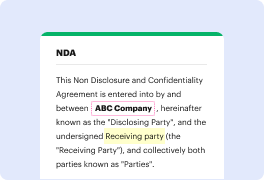

good afternoon Im here in my office on a Saturday and I just wanted to cut a short video this is for the Fair Credit Reporting Act a credit damage as part of my practice and theres some very important information that consumers need to know given right now that a lot of consumers are approaching banks and mortgage lenders and car lenders and theyre asking for or forbearance agreements and now what a forbearance is remember a forbearance is the bank or the lender is not forgiving your payments what theyre doing is theyre theyre saying in May June and July of 2020 you dont have to pay them but at the end of your you know at the end of your term for that particular loan theyll tack on three months that you have to pay then so really what theyre doing is theyre forgiving the loan at this moment but theyre taking that same those same two three four or five payments theyre attacking them on at the end okay now what happens in forbearance agreements a lot of times is that people e