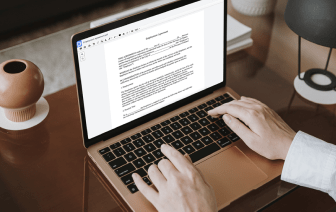

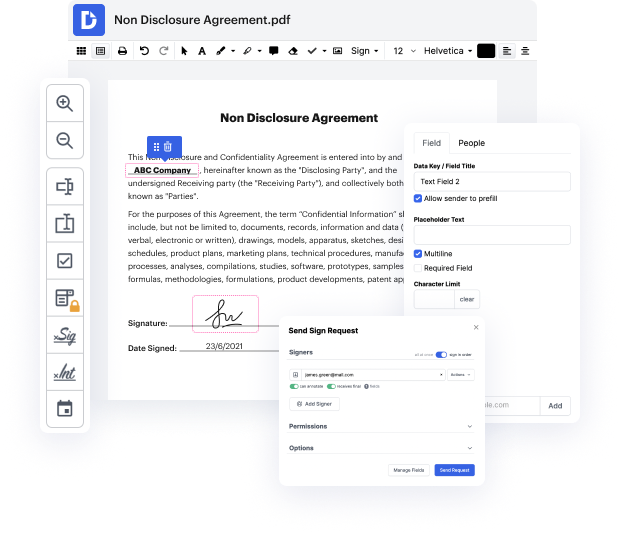

Time is a crucial resource that every enterprise treasures and tries to transform into a gain. When picking document management application, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge tools to enhance your file management and transforms your PDF file editing into a matter of a single click. Replace Amount Field to the Letter Approving Credit Application with DocHub to save a ton of time and enhance your productiveness.

Make PDF file editing an simple and easy intuitive process that helps save you plenty of precious time. Quickly modify your files and deliver them for signing without the need of turning to third-party software. Focus on pertinent duties and boost your file management with DocHub today.

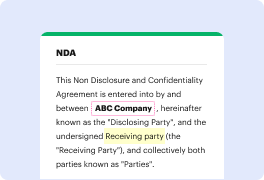

[Music] hey guys good afternoon Angelo Christian Financial and you know one of the biggest things that we talk about here with our company we are a direct you know nationwide lender for commercial and residential lending but we always help people with their credit because thats a huge part of getting a loan is your actual credit score so weve been talking a lot of lately about how to delete things off your credit and Ive shot a lot of videos on that and we actually explain the process of how to remove things off your credit today were actually looking at absolutely ready position letter this is after youve disputed something on your credit and what it looks like when you actually get a deletion letter in the mail from the actual credit bureau in this case its Equifax deleting something off of a this is a simulation its an actual real letter but weve removed all of the persons identity on the letter obviously but its or its a legitimate real letter from Equifax showing what i