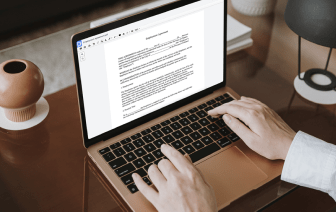

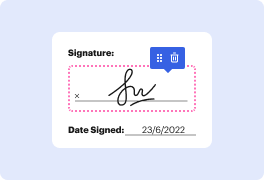

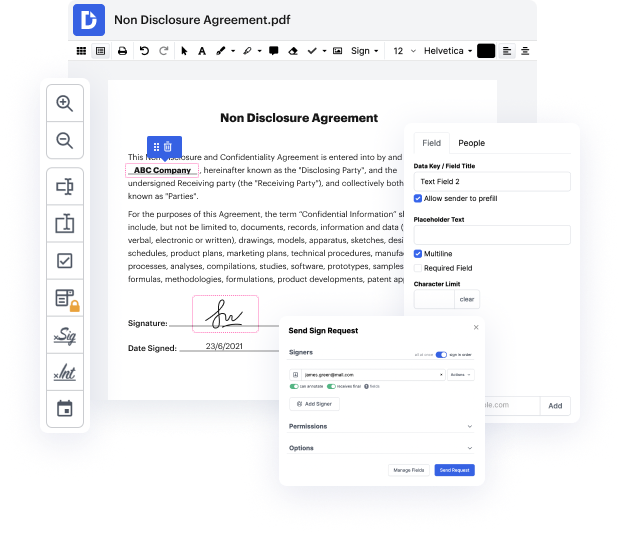

Document-centered workflows can consume plenty of your time and effort, no matter if you do them regularly or only from time to time. It doesn’t have to be. In fact, it’s so easy to inject your workflows with extra productivity and structure if you engage the proper solution - DocHub. Sophisticated enough to tackle any document-related task, our software lets you alter text, pictures, notes, collaborate on documents with other users, generate fillable forms from scratch or web templates, and digitally sign them. We even safeguard your data with industry-leading security and data protection certifications.

You can access DocHub tools from any location or device. Enjoy spending more time on creative and strategic work, and forget about tiresome editing. Give DocHub a try today and see your Form W-4 workflow transform!

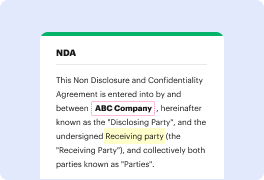

hello everyone today were going to go over the essentials of how to fill out the IRS sw4 form this document is a key element in your employment Journey playing a pivotal role in determining how much federal income tax is withheld from your paycheck in addition to covering the basics were going to delve into steps 2 to four focusing on scenarios such as having multiple jobs claiming dependence understanding deductions and accounting for other forms of income plus well explore the IRS tax estimator tool an important aid for ensuring your tax calculations are on point so lets get started the W4 form is a document you present to your employer either when youre starting a new job or when theres a docHub change in your tax situation its the blueprint that guides your employer in withholding the correct amount of federal income tax ensuring that your tax obligations align closely with your actual tax liability this alignment is vital in avoiding a hefty tax bill at the end of the