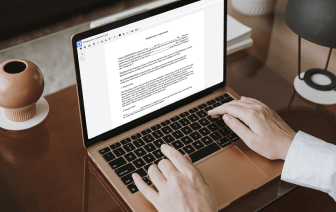

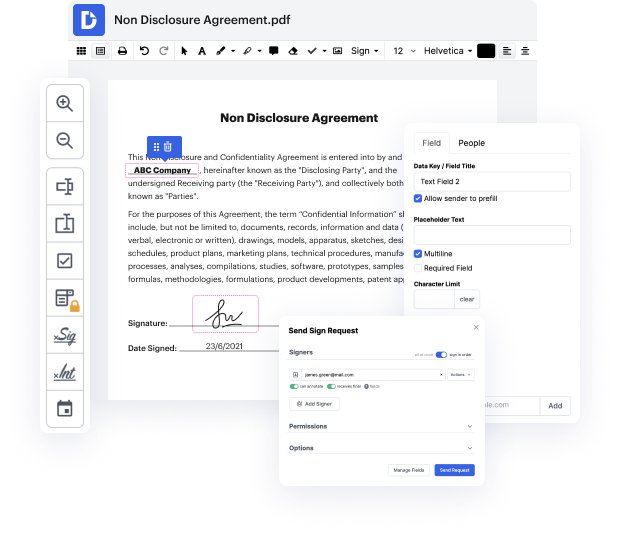

Document-based workflows can consume a lot of your time and energy, no matter if you do them routinely or only from time to time. It doesn’t have to be. In reality, it’s so easy to inject your workflows with additional productivity and structure if you engage the proper solution - DocHub. Sophisticated enough to handle any document-connected task, our software lets you alter text, pictures, comments, collaborate on documents with other users, produce fillable forms from scratch or templates, and digitally sign them. We even shield your information with industry-leading security and data protection certifications.

You can access DocHub tools from any location or device. Enjoy spending more time on creative and strategic work, and forget about monotonous editing. Give DocHub a try right now and see your Donation Receipt workflow transform!

when it comes to tax season silent gratitude isnt much use to anyone but delivering a prompt easily accessible 501c3 receipt is the golden ticket to the long lasting donor relationships IRS compliance sustainability and the smooth operation of your organization a donation receipt is simply a written acknowledgment that a legal donation was made to have registered 501c3 tax-exempt organization formed in the United States this kind of donation allows donors to legitimately reduce the amount of income tax they pay annually but it can also do so much more especially online where the anxiety of was it successful can suck the joy out of the gesture always try to follow best practices on when to send a 501c3 receipt which is usually within 24 to 48 hours of the donation being made this is so important remember a receipt must be generated for a single donations greater than two hundred and fifty dollars when a donor received goods or services in exchange for a si