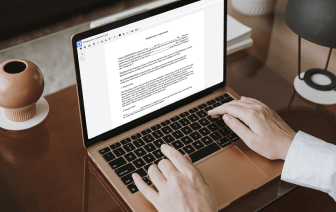

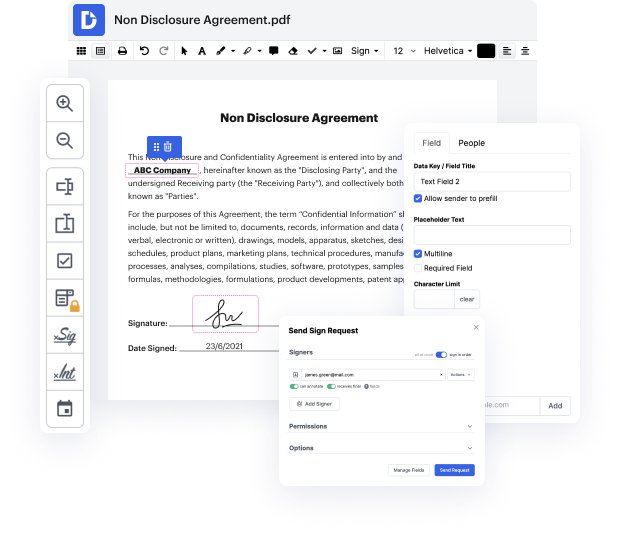

Time is a crucial resource that every business treasures and tries to transform in a gain. When choosing document management application, focus on a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge instruments to improve your document management and transforms your PDF editing into a matter of a single click. Remove Symbols to the Consumer Credit Application with DocHub to save a ton of time as well as enhance your productiveness.

Make PDF editing an easy and intuitive process that will save you a lot of valuable time. Effortlessly change your files and send them for signing without the need of looking at third-party software. Focus on relevant duties and boost your document management with DocHub right now.

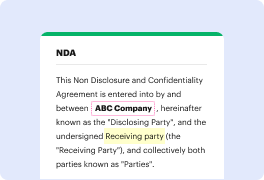

hey guys so what is the difference between a consumer credit application and a job application both applications are asking you for the same information your social and address references so what is the difference the difference is your consumer credit application is you requesting immediate access to an extension of your own money a job application is you requesting to do manual labor to receive your own money so both applications are you requesting extension