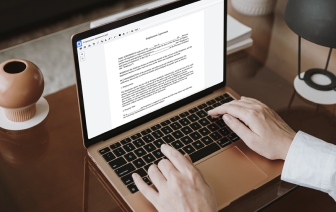

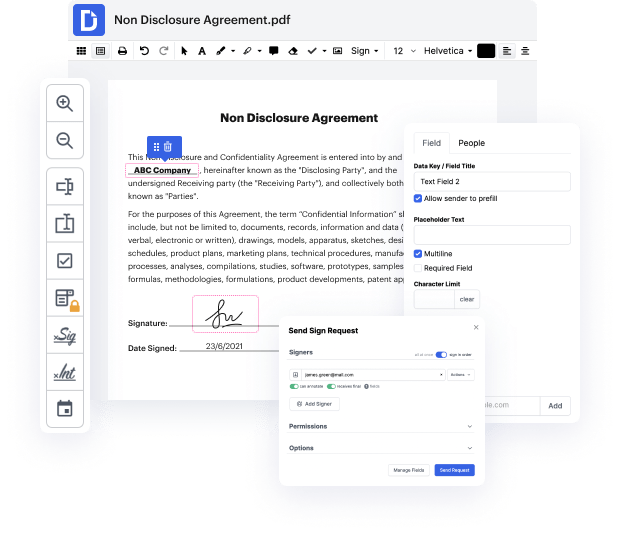

Time is an important resource that every enterprise treasures and attempts to turn in a advantage. When picking document management application, focus on a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge features to improve your file managing and transforms your PDF editing into a matter of one click. Remove SNN Field to the Agreement To Extend Debt Payment with DocHub in order to save a ton of time as well as improve your productiveness.

Make PDF editing an simple and intuitive operation that helps save you plenty of precious time. Effortlessly modify your documents and deliver them for signing without looking at third-party solutions. Focus on pertinent tasks and improve your file managing with DocHub starting today.

todays question comes from Stephanie in Nevada where do collections fall and baby step two do we pay them first or in the order their balances like everything else if youve got outstanding defaulted bad debt set that aside youre not paying on it anyway and figure and finish your debt snowball and baby step two that is your regular active debts things your paying payments on list your debts smallest to largest pay minimum payments on everything but the little one and work your way right down that list now once all of your active debts are gone then take all of your defaulted in collections that youre not paying payments on debt inactive debt and list its smallest to largest only were not going to pay them payments were going to just pay them off smallest to largest now if it is a small debt under $300 you call them up you get in writing by email or something like that what the balance is not verbal over the phone its an old debt you dont want to send them $275 from a six-month a