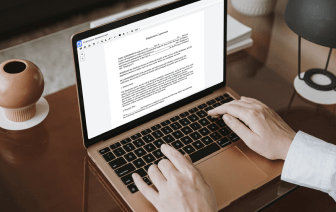

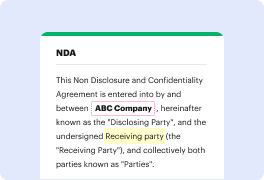

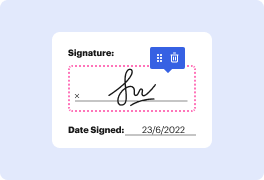

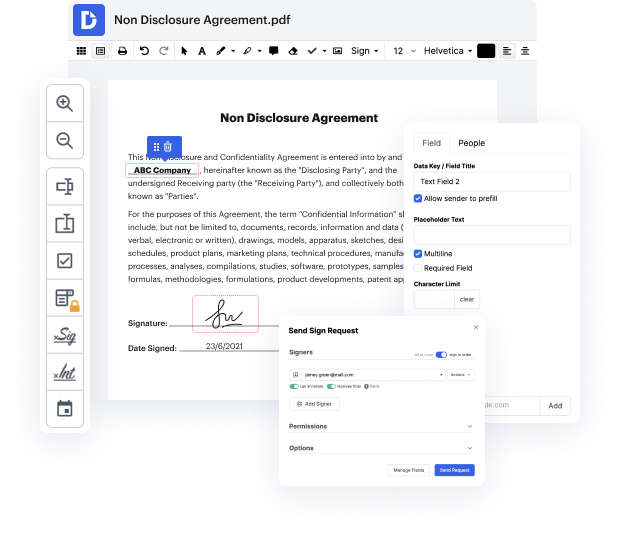

Time is a crucial resource that each enterprise treasures and tries to convert into a gain. When picking document management software, focus on a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge tools to enhance your document managing and transforms your PDF editing into a matter of a single click. Remove Signature via QR Code in the Bridge Loan Agreement with DocHub in order to save a lot of efforts and boost your efficiency.

Make PDF editing an simple and intuitive process that will save you a lot of valuable time. Easily change your documents and send them for signing without the need of adopting third-party software. Give attention to relevant duties and boost your document managing with DocHub today.

hey whats going on guys victor chambers here back with another video and in this video i want to show you how i do scan backs without a scanner now as a loan signing agent being able to do scan backs is actually a very critical part of doing loan signings and theyre not required for every single assignment that youll complete but in my case about 20 to 25 of the assignments i do actually require scan backs and that could require a scan back of the entire package or just certain documents in the package and so that this is actually a very critical thing to be able to do when youre doing loan signings because youll have to scan back packages before you actually drop them off at the fedex or ups store if thats part of the instructions for the specific assignment now this was a highly requested video a lot of you were interested in learning more about how i do scan backs if you saw my video where i talked about the best apps for loan signing agent i talked about the specific app that