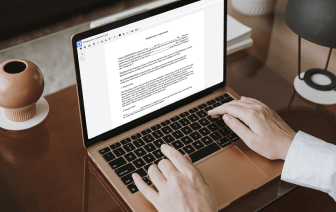

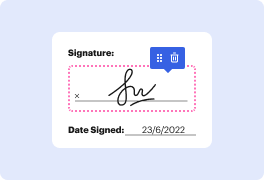

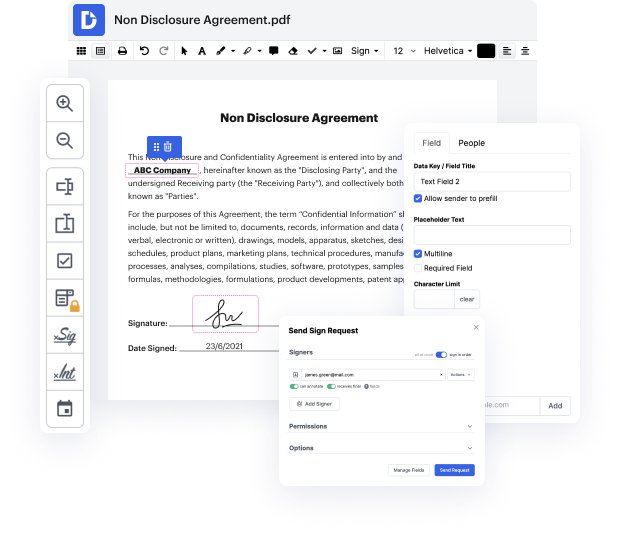

Time is a vital resource that each organization treasures and tries to turn into a reward. When choosing document management application, be aware of a clutterless and user-friendly interface that empowers consumers. DocHub provides cutting-edge features to maximize your file management and transforms your PDF file editing into a matter of a single click. Remove Signature into the Personal Loan Contract with DocHub in order to save a lot of time and improve your productivity.

Make PDF file editing an easy and intuitive process that will save you a lot of valuable time. Quickly modify your files and send them for signing without looking at third-party options. Concentrate on relevant tasks and improve your file management with DocHub right now.

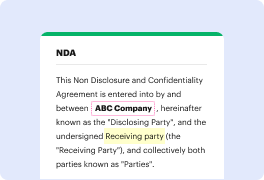

this is financial advisor patrick monroe talking about signature loans signature loans are a great opportunity for someone to work with a financial institution that believes in them the reason they believe in them is because theyve got great credit uh that they have demonstrated themselves to the financial institution uh that theyre a good credit risk and the institution therefore gives them a predetermined credit line based just on their strength of signature its a senior product for individuals that are credit worthy and uh it is called a signature loan its an old type loan that was normally given to nobility in the past based on the family name but of course we dont live in aristocracy type situations anymore in america so the prevailing benchmark for signature loans is your credit and your outstandingness as far as how the financial institution believes in you this is patrick monroe talking about the tool known as signature loans