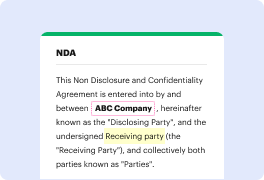

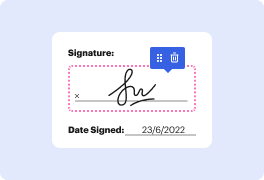

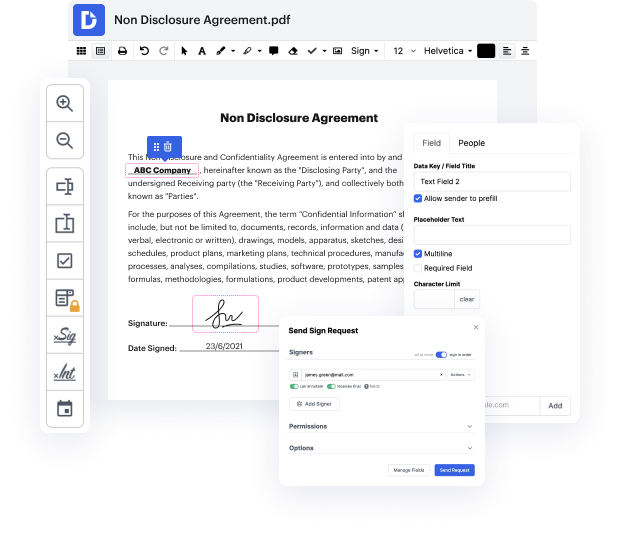

Time is a vital resource that every enterprise treasures and tries to convert into a benefit. When choosing document management software, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge features to optimize your document managing and transforms your PDF editing into a matter of a single click. Remove Required Fields from the Vat Invoice with DocHub to save a ton of time as well as boost your productiveness.

Make PDF editing an easy and intuitive operation that saves you plenty of precious time. Effortlessly alter your files and send them for signing without having looking at third-party alternatives. Give attention to pertinent duties and improve your document managing with DocHub starting today.