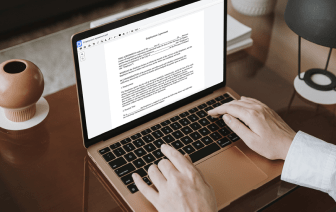

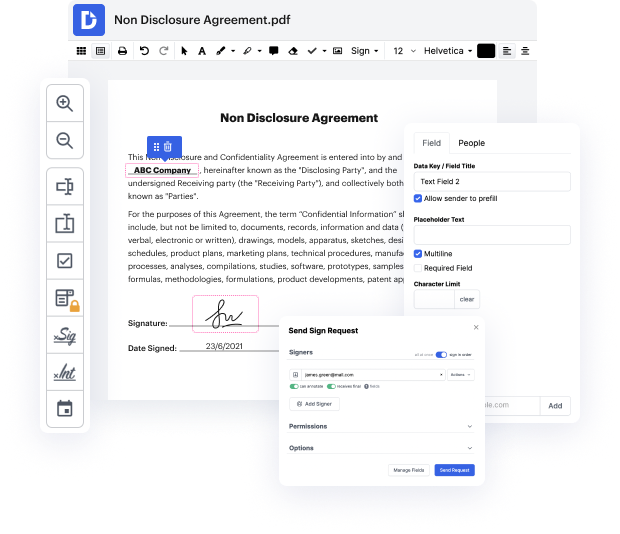

Time is a vital resource that each business treasures and attempts to transform in a gain. When choosing document management software program, be aware of a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge features to optimize your document management and transforms your PDF editing into a matter of a single click. Remove Radio Button Groups from the Notice Of Credit Limit Increase with DocHub in order to save a lot of efforts and boost your productiveness.

Make PDF editing an simple and intuitive process that helps save you plenty of precious time. Effortlessly change your files and send them for signing without turning to third-party alternatives. Concentrate on pertinent duties and enhance your document management with DocHub today.

Capital One credit increase hack and this just proves why so many people are having trouble getting a higher credit limit Im going to show you step by step how to get more credit with your Capital One credit card before we jump into it you have to understand that Capital One system is entirely online and a physical person is not looking at your credit limit increase next lets look at what factors Capital One considers for a credit limit increase youll need to provide your total annual income employment status and monthly mortgage or rent payment keywords you want to take a look at income and employment now you want to go to your Capital One app or online you want to up to your income and employment before requesting the credit limit increase so it updates in the system the last parts most important you want to go to this chat box you want to type in credit increase you want to fill out that form below but keep in mind Capital One will allow you to request a credit limit increase as