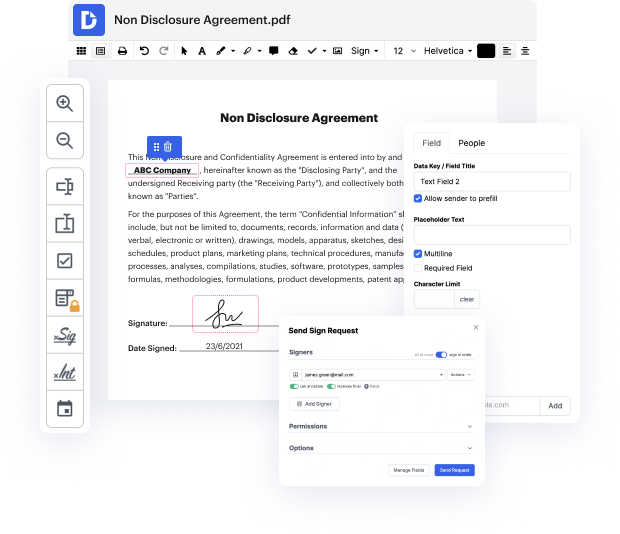

Time is an important resource that every enterprise treasures and tries to convert into a benefit. When picking document management software program, focus on a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge features to enhance your file administration and transforms your PDF editing into a matter of one click. Remove Payment Field into the Income Statement Quarterly with DocHub in order to save a lot of efforts and boost your productivity.

Make PDF editing an simple and easy intuitive operation that saves you plenty of valuable time. Easily modify your files and send out them for signing without switching to third-party alternatives. Concentrate on pertinent tasks and increase your file administration with DocHub today.

welcome back Adam here today Im going to be showing you how you can reduce your self-assessment payments on account now typically payments on account will occur unless your last self-assessment tax bill was less than a thousand pounds or anything more than that and youre going to incur payments on account or unless you paid more than 80 of the previous years tax owed so examples of this will be where your main income is from employment if all of the taxes being collected at Source by your employer then theres going to be no need for payments on account but if you have a chunk of income where tax isnt being deducted at source then theres a likelihood that you actually need to make payments on account there as well now this wont usually be a problem once you get into the second year of your self-assessment and then moving forward but in the first year payments on account down can come as a bit of a shock as hmrc will ask the taxpayer to pay 100 of the liability for the tax year th