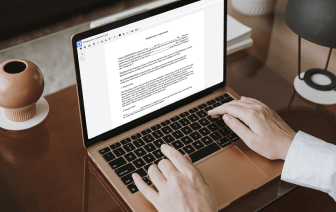

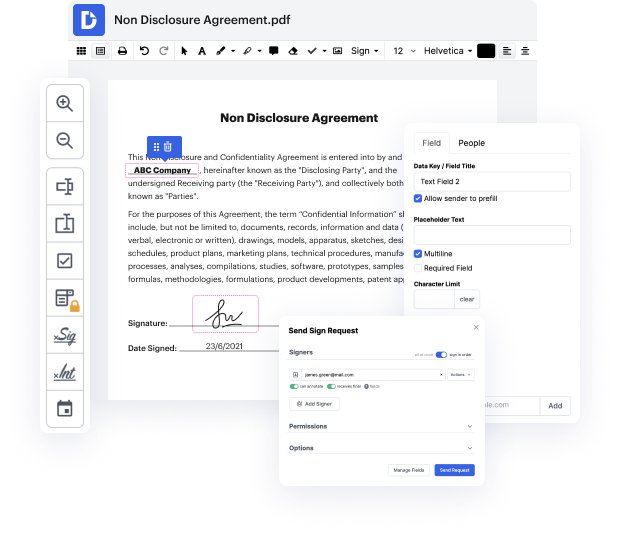

Time is a crucial resource that each business treasures and tries to turn in a benefit. When choosing document management software program, take note of a clutterless and user-friendly interface that empowers users. DocHub provides cutting-edge tools to maximize your document administration and transforms your PDF editing into a matter of one click. Remove Option Choice into the Payroll Deduction Authorization with DocHub in order to save a ton of efforts and boost your efficiency.

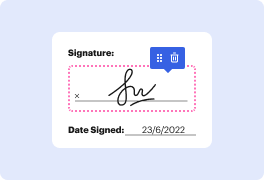

Make PDF editing an simple and easy intuitive operation that will save you plenty of precious time. Quickly adjust your documents and give them for signing without having looking at third-party solutions. Give attention to relevant duties and improve your document administration with DocHub today.

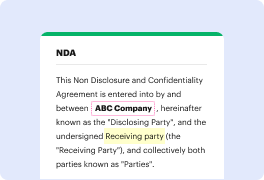

hi there in this quickbooks online video well quickly look at custom deductions and remitting those deductions from paychecks so im going to quickly log in and im going to choose payroll employees im going to quickly add a new employee and i just tired for today im going to add my own email just so i can see the type of messages we get im going to quickly add her td1 information and your social insurance number ill quickly copy and paste from when i have and ill add our address and her postal code and im done with her td-1 shes a very basic employee no dependents so just the basic amount and we pay her every friday starting this friday and she makes 25 dollars an hour she works seven hours a day five days a week we also pay her overtime and double overtime if she works more than eight hours or 12 hours a day she we accrue her vacation so that is we added to each check and we put it into a paperless account for when she takes a vacation and im going to quickly add some custom