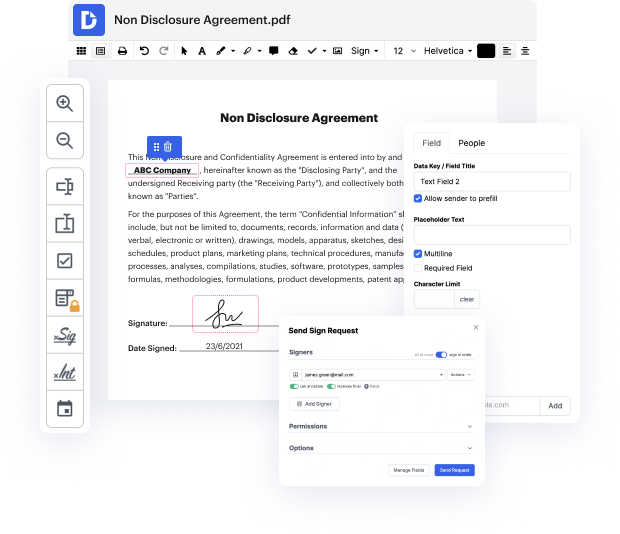

Time is a vital resource that every enterprise treasures and tries to turn in a benefit. When selecting document management application, be aware of a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge features to improve your document management and transforms your PDF editing into a matter of a single click. Remove Mandatory Field into the Debt Settlement Agreement Template with DocHub to save a lot of time and increase your efficiency.

Make PDF editing an easy and intuitive process that saves you plenty of valuable time. Effortlessly change your files and send out them for signing without the need of turning to third-party software. Concentrate on pertinent duties and increase your document management with DocHub today.

A debt settlement agreement is generally used to confirm a renegotiation or settlement of the original agreement between the debtor and the creditor. A debt settlement agreement usually reduces or eliminates the original amount of debt between the parties and allows the creditor to forgive part of the debt by releasing the debtor from any remaining obligation. Usually in exchange of the last payment made by the debtor to the creditor after the execution of the debt settlement a. The creditor should remove any obligation of the debtor under the original contract and renounced to pursue any auction against the debtor in relation to the original agreement.