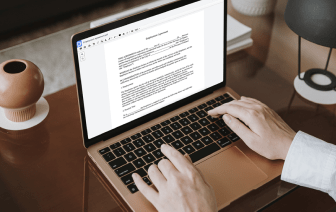

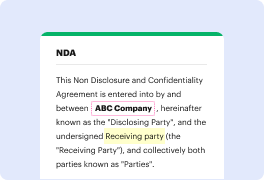

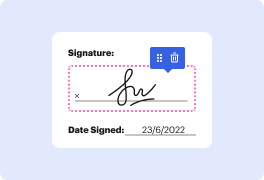

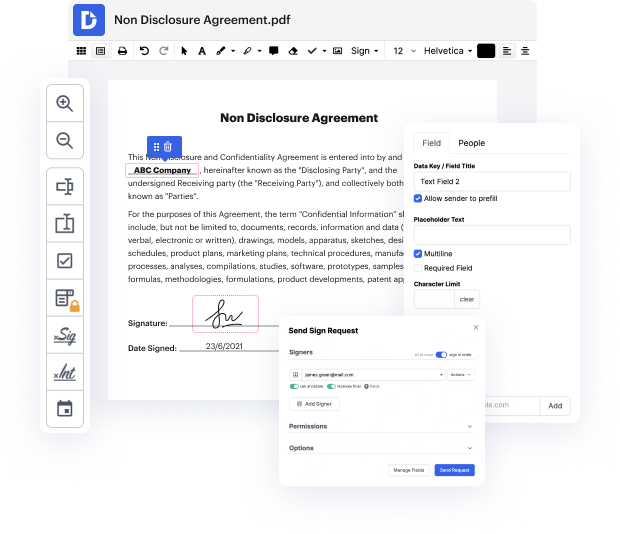

Time is a crucial resource that every organization treasures and attempts to transform in a advantage. When choosing document management software program, take note of a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge instruments to optimize your document management and transforms your PDF editing into a matter of one click. Remove Line from the Deferred Compensation Plan with DocHub to save a lot of time and boost your productivity.

Make PDF editing an simple and intuitive process that helps save you a lot of precious time. Quickly change your files and send out them for signing without having turning to third-party options. Focus on pertinent tasks and increase your document management with DocHub starting today.

hi were here today with Brian Weldon audit manager with Baker Tilley he was also the author of the summer 2017 employee benefits plans piece in the Pennsylvania CPA Journal titled deferred compensation plan errors and how to correct them so its good to be able to have this opportunity to go a little deeper on the column for people who enjoyed it so thanks for being with us sure well Im glad to be here absolutely now the first question that we have and if this will be sort of a broader type question before we go a little deeper I mean if you discover that youve made an error with your deferred compensation plan how important is it for you to act urgently to correct it Id say its very important the thing to remember and the recurring theme throughout the article and this interview is that were talking about peoples money for retirement which is a pretty hot topic for anyone who has money saved for retirement and the employee retirement income savings Act of 1974 ERISA was establi