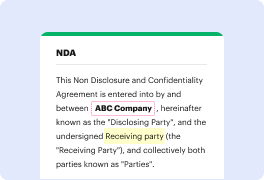

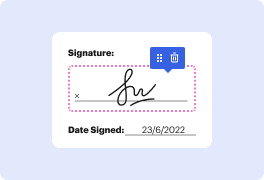

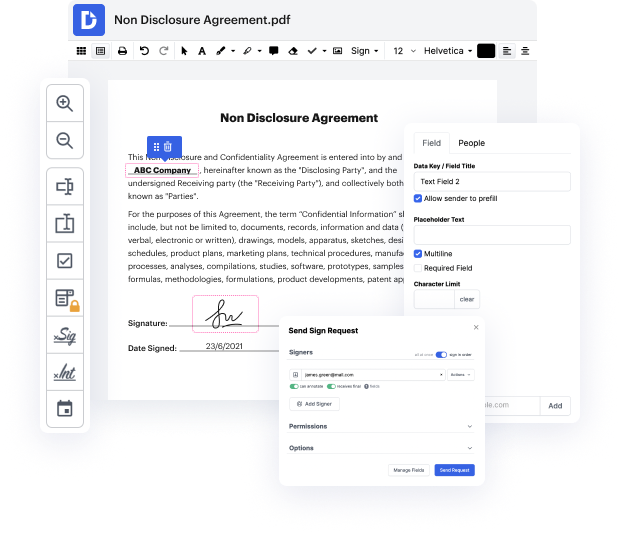

Handling and executing paperwork can be tiresome, but it doesn’t have to be. Whether you need help day-to-day or only sometimes, DocHub is here to supply your document-centered projects with an extra efficiency boost. Edit, comment, fill out, sign, and collaborate on your W-9 Tax Form rapidly and easily. You can modify text and pictures, build forms from scratch or pre-made templates, and add eSignatures. Owing to our top-notch security measures, all your information stays safe and encrypted.

DocHub offers a complete set of tools to streamline your paper processes. You can use our solution on multiple platforms to access your documents anywhere and anytime. Improve your editing experience and save hours of handiwork with DocHub. Try it for free right now!

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more