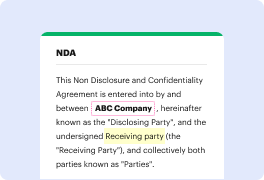

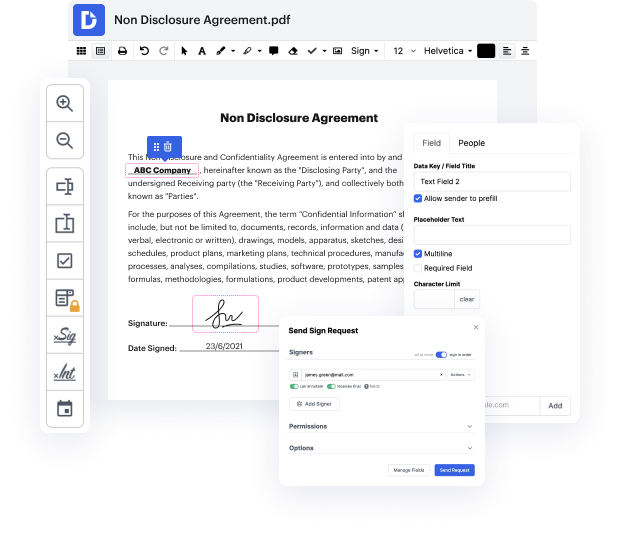

Time is a crucial resource that each business treasures and tries to change into a advantage. When picking document management software, focus on a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge tools to enhance your document administration and transforms your PDF editing into a matter of one click. Remove EU Currency Field to the Vat Invoice with DocHub to save a lot of time as well as enhance your efficiency.

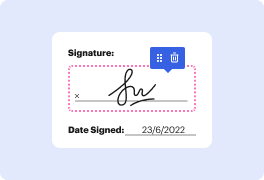

Make PDF editing an simple and intuitive process that helps save you a lot of precious time. Quickly adjust your files and deliver them for signing without having looking at third-party options. Focus on pertinent duties and improve your document administration with DocHub starting today.