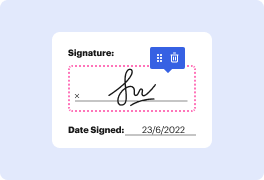

Time is a vital resource that each organization treasures and tries to transform in a advantage. When picking document management software, focus on a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge features to improve your document managing and transforms your PDF file editing into a matter of one click. Remove Electronic Signature in the Partnership Amendment with DocHub in order to save a ton of time as well as improve your productivity.

Make PDF file editing an simple and intuitive process that will save you a lot of valuable time. Effortlessly change your documents and send them for signing without switching to third-party options. Concentrate on pertinent duties and improve your document managing with DocHub right now.

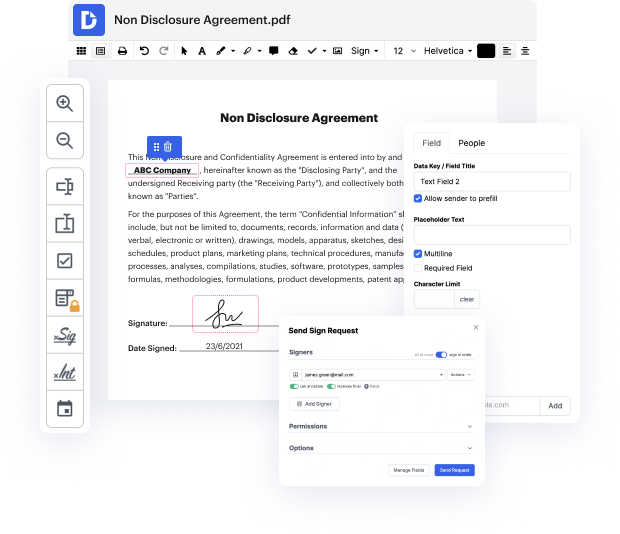

hello everyone so today were going to be going over how to delete a digital signature from your PDF documents from behind the scenes especially if a client has discharged you dont want their certificate to keep coming up you want to be able to remove that okay so youre gonna be starting in any PDF document and youre gonna go to edit and youre gonna go down to preferences okay and youre going to want to make sure that signatures is highlighted and you want to go to identities and trusted certificates and youre gonna hit more okay and now it comes up with the digital ID and trusted certificate settings and so youre gonna want to click on this little icon that has the badge plus icon and the add digital ID box is gonna pop up you want to choose the default which is my existing digital ID from a file and hit next next its going to have the file name and password so you just want to be able to hit browse on that the next option it gives you different options of certificate names an