Document generation and approval are a core priority of every firm. Whether handling sizeable bulks of documents or a distinct agreement, you need to stay at the top of your efficiency. Finding a excellent online platform that tackles your most common file generation and approval problems may result in a lot of work. Many online apps offer only a limited set of editing and signature capabilities, some of which could possibly be beneficial to handle doc formatting. A solution that handles any formatting and task will be a outstanding option when choosing application.

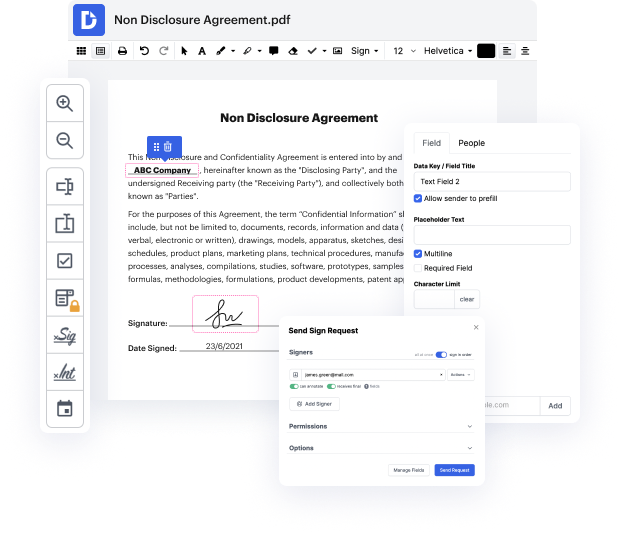

Take file management and generation to a different level of simplicity and sophistication without choosing an cumbersome program interface or pricey subscription options. DocHub offers you tools and features to deal effectively with all of file types, including doc, and carry out tasks of any difficulty. Edit, manage, that will create reusable fillable forms without effort. Get total freedom and flexibility to remove ein in doc at any moment and safely store all of your complete files within your user profile or one of several possible integrated cloud storage space apps.

DocHub offers loss-free editing, eSignaturel collection, and doc management on a professional levels. You do not need to go through exhausting tutorials and spend hours and hours figuring out the application. Make top-tier safe file editing an ordinary process for the day-to-day workflows.

okay in this video i wanted to talk about the procedures for canceling an ein with the irs so an ein is an employer identification number its effectively the tax id number thats assigned to a business so its a sole proprietorship business or business entity it can even be assigned to trusts estates joint ventures charitable organizations effectively its the tax id number for anything thats not lets say an individual person okay now so just to start with um you cant actually cancel your ein so once the ein is assigned to a business entity or again like a trust a state charitable organization sole proprietorship joint venture whatever it is once that ein is issued it remains attached to that entity name or business name and its never reused or recycled and so for those reasons you cant actually cancel it because again its never going to come up again so the only way you can really cancel it or one of two ways right and again cancel is not the best term because its not closed

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more