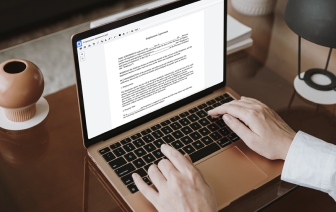

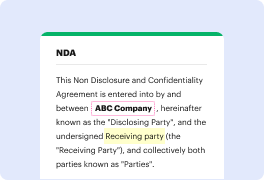

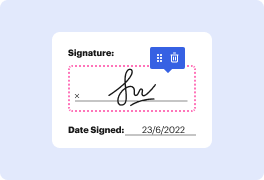

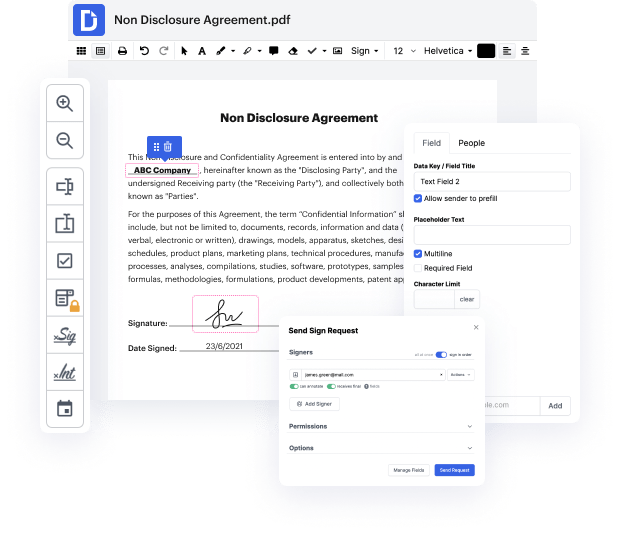

Time is a crucial resource that every enterprise treasures and attempts to change into a reward. When selecting document management application, pay attention to a clutterless and user-friendly interface that empowers users. DocHub provides cutting-edge instruments to enhance your file management and transforms your PDF editing into a matter of a single click. Remove Cross Out Option into the Bank Loan Proposal with DocHub in order to save a lot of efforts and improve your productiveness.

Make PDF editing an easy and intuitive process that helps save you a lot of valuable time. Easily alter your files and deliver them for signing without the need of turning to third-party software. Give attention to pertinent tasks and boost your file management with DocHub today.

hi there mark cunningham here and in this video were going to take a look at two ways that you can fix your bank reconciliation errors in xero if youve made a mistake and they are unreconcile and remove and redo so if you go into your business bank account well just go over to the account transactions tab and we can see all of our transactions here in the general ledger that have been reconciled and what well do is well pick one to work on and well do this ebank dep for a thousand dollars on the fifth of november so we can see there that its been reconciled so thats the general ledger transaction if we go to bank statements and we just go and find it okay there it is there fifth of november thousand dollars so thats been reconciled over here as well so thats where both sides of the transaction are and they both say theyve been reconciled which is great so if i go back to account transactions and well just go find it again and click into the transaction okay so what weve go