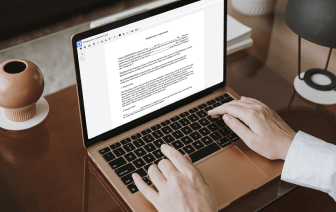

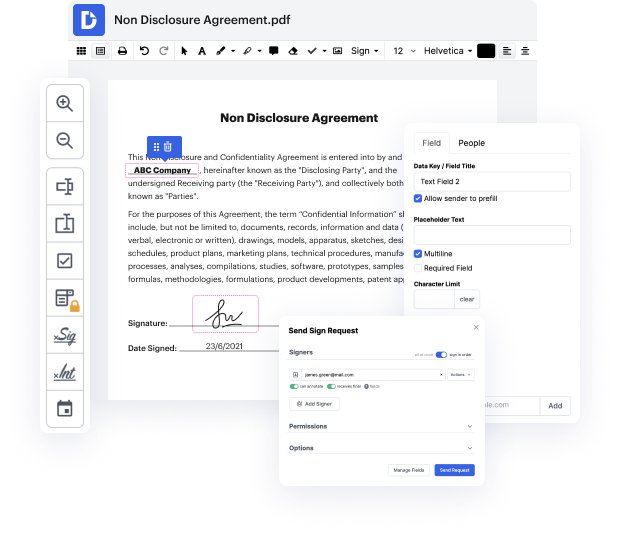

Time is an important resource that each organization treasures and attempts to transform in a advantage. When selecting document management software program, focus on a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge features to improve your file managing and transforms your PDF file editing into a matter of one click. Remove Amount Field to the Notice Of Default Letter with DocHub in order to save a ton of time as well as enhance your productivity.

Make PDF file editing an easy and intuitive process that will save you a lot of valuable time. Easily adjust your documents and send them for signing without turning to third-party solutions. Focus on relevant tasks and improve your file managing with DocHub starting today.

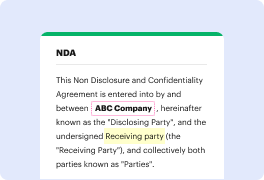

when you get a debt-collection notice or a default notice from your mortgage lender how should you respond should you respond at all my name is Michael Wasik Im a Florida foreclosure defense lawyer from Ricardo and wasps like my partner night Jason Ricardo my partner Jason Ricardo and I help people just like you overcome foreclosure with dignity what Id like to address today is the question of what to do when you get one of those letters from your bank that says youre in default youre behind your mortgage payments demanding payment or theyre threatening to foreclose how should you respond should you respond at all Ive used this information to help many many homeowners just like you protect their homes from foreclosure so lets talk about what the best way is to respond first of all before you can know how to respond to any correspondence you get from your mortgage lender or from your mortgage servicer you need to understand what is the document youre getting now generally speaki