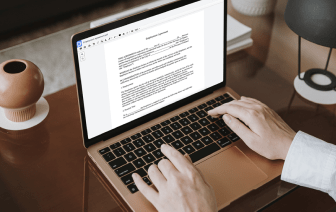

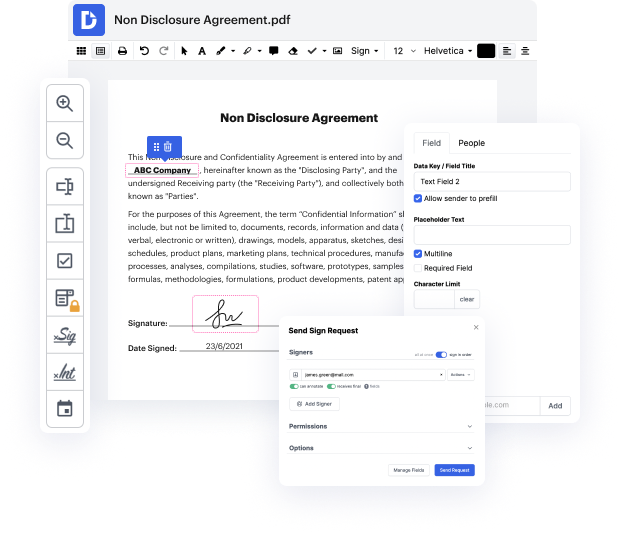

Time is an important resource that each enterprise treasures and tries to change into a gain. When picking document management software, focus on a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge tools to improve your document managing and transforms your PDF editing into a matter of one click. Remove Amount Field to the Declaration Of Trust with DocHub to save a lot of time as well as boost your productivity.

Make PDF editing an simple and intuitive operation that saves you a lot of valuable time. Quickly adjust your documents and give them for signing without the need of looking at third-party options. Give attention to pertinent duties and boost your document managing with DocHub right now.

can a trustee remove a beneficiary when administering a trust the trustee has a fiduciary duty to distribute the estate assets as specified in the trust instrument a trustee cannot frivolously decide to remove a beneficiary from the trust distribution but there are certain circumstances in which trustee may remove a beneficiary [Music] a revocable trust settler is the person who establishes the trust as the original trustee they hold the right to change the trust distribution at any time prior to their death after the original trustee dies the revocable living trust becomes an irrevocable trust the successor trustee named in the trust document then steps into their role regardless of how the trustee thinks the trust should be distributed they have a fiduciary duty to administer the terms of the trust as written some trusts may grant the trustee the power to determine whether and when to distribute trust assets to a beneficiary but not to remove them completely unless they were granted