At the first blush, it may seem that online editors are pretty much the same, but you’ll realize that it’s not that way at all. Having a powerful document management solution like DocHub, you can do far more than with standard tools. What makes our editor unique is its ability not only to quickly Remove account in Church Donation Receipt but also to create paperwork completely from scratch, just the way you need it!

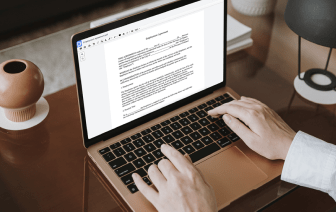

Despite its comprehensive editing capabilities, DocHub has a very simple-to-use interface that offers all the features you want at your fingertips. Therefore, modifying a Church Donation Receipt or an entirely new document will take only a few minutes.

Register for a free trial and celebrate your greatest-ever paperwork-related practice with DocHub!

its better to give than to receive weve all heard the phrase but as a bonus the ux tax code allows us to receive when we give in the form of tax deductions that can lower your tax bill and today were going over everything you need to know about deductible donations well be covering what types of donations are eligible how to claim the deduction if it even makes sense for you to donate for tax purposes and everything in between note that for guidance or advice specific to your situation you should consult with your tax illegal professional before we get started go ahead and like this video right now to let me know youre pumped and as a bonus it helps others find our channel on youtube and subscribe to see more videos that will help you save on your taxes lets start with what organizations are eligible for deductions only donations that go to a taxes them organization or qualified organizations qualify for tax deductions so friends and family unfortunately do not qualify for a tax