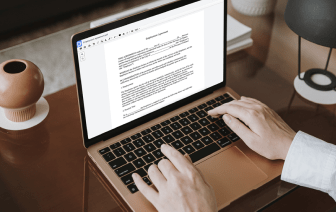

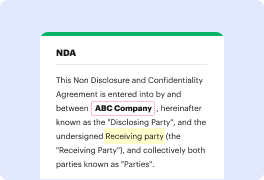

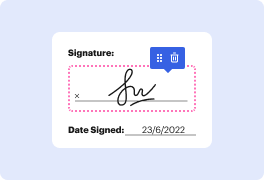

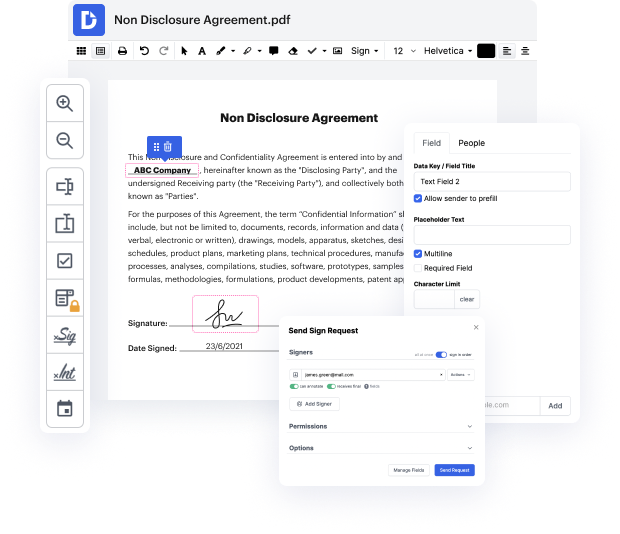

Many people find the process to redo payer in tex quite difficult, particularly if they don't frequently work with paperwork. However, nowadays, you no longer need to suffer through long guides or spend hours waiting for the editing app to install. DocHub allows you to modify forms on their web browser without installing new programs. What's more, our robust service offers a complete set of tools for comprehensive document management, unlike numerous other online tools. That’s right. You no longer have to export and import your forms so frequently - you can do it all in one go!

Whatever type of paperwork you need to alter, the process is easy. Benefit from our professional online service with DocHub!

i completely transform my old sad backyard into a beautiful grassy lawn hereamp;#39;s a few steps on how i did it i first hand removed all the weeds and made sure that we had a proper soil to begin with i then brought in 12 yards of topsoil to enrich the soil itself this is a lot of soil to handle with a wheelbarrow so you might want to actually rent a device to help you maneuver all the soil around after i had two to three inches of soil over the entire area i brought in some seed lime and fertilizer and before i applied my seed i actually took a tiller and tilled the entire backyard three times in multiple directions i then smoothed out the backyard with a large lawn roller that you fill up with water and is extremely easy to use once you get it rolling i applied five to seven pounds of seed per thousand square foot and then once all the seed was down i put a bit more soil right on top and smoothed it out ingly i watered it twice a day for two weeks and it started looking like this