Not all formats, such as cgi, are developed to be easily edited. Even though many tools can help us modify all form formats, no one has yet invented an actual all-size-fits-all tool.

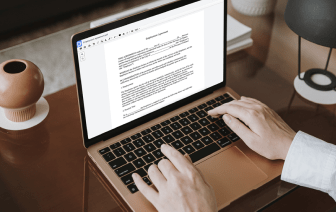

DocHub offers a straightforward and efficient tool for editing, taking care of, and storing documents in the most popular formats. You don't have to be a tech-knowledgeable user to redo FATCA in cgi or make other modifications. DocHub is robust enough to make the process easy for everyone.

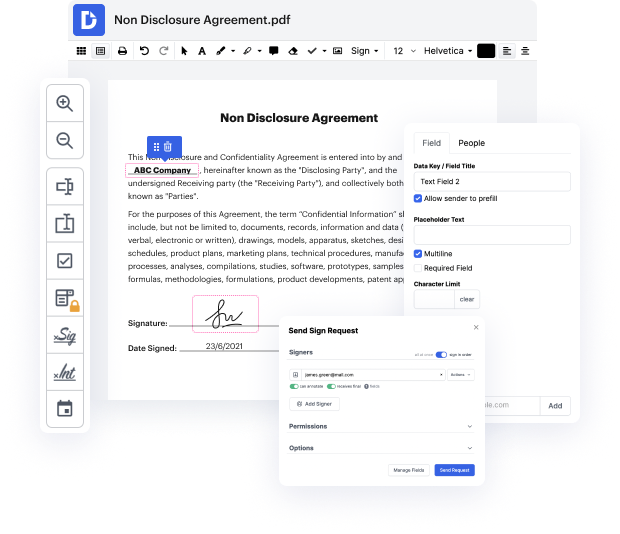

Our feature enables you to modify and tweak documents, send data back and forth, generate dynamic forms for data gathering, encrypt and safeguard paperwork, and set up eSignature workflows. In addition, you can also create templates from documents you utilize frequently.

You’ll find a great deal of other functionality inside DocHub, such as integrations that allow you to link your cgi form to various business apps.

DocHub is a straightforward, fairly priced way to deal with documents and improve workflows. It offers a wide array of capabilities, from creation to editing, eSignature services, and web form creating. The software can export your paperwork in multiple formats while maintaining maximum security and following the highest data protection requirements.

Give DocHub a go and see just how easy your editing operation can be.

good afternoon this is sean golding with goldie and golding here to discuss the basics of what is fatca what is the foreign account tax compliance act why do you care and how do you comply right like a fatca foreign account tax compliance act uh for u.s person this presentation is focused toward uh individuals uh u.s entities trusted in states that have to report not foreign financial institutions that have their own requirement from a tax perspective fact it came into effect in 2011 on the tax return whereas us persons have to include form 8938 if they meet the threshold requirements for reporting itamp;#39;s used to report specified foreign financial assets itamp;#39;s different than the f bar the f bar is another acronym thrown around on all foreign bank and financial account reporting the fbar is covered under title 31 which is money in finance not 26 which is the internal revenue code an important aspect of that is that when youamp;#39;re filing the uh the f bar youamp;#39;re