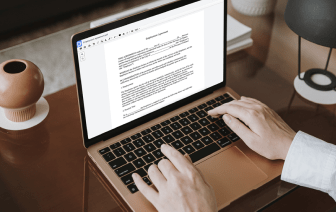

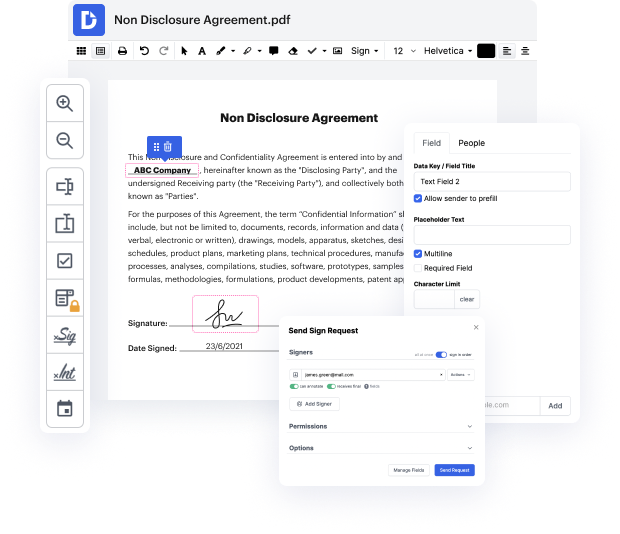

DocHub makes it fast and straightforward to paste FATCA in csv. No need to download any software – simply add your csv to your account, use the easy drag-and-drop user interface, and quickly make edits. You can even work on your desktop or mobile device to adjust your document online from any place. That's not all; DocHub is more than just an editor. It's an all-in-one document management platform with form constructing, eSignature capabilities, and the option to allow others fill in and sign documents.

Every file you upload you can find in your Documents folder. Create folders and organize records for easier search and retrieval. Additionally, DocHub ensures the safety of all its users' information by complying with strict protection protocols.

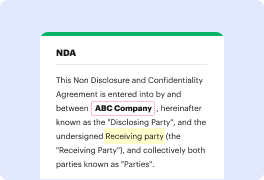

an american initiative to catch their tax dodgers could prove costly for jamaican financial institutions and thereamp;#39;s apparently no way to avoid it well unless of course if local institutions do not volunteer to participate and thus face punitive charges we have a special report in your wealth jamaicans better get accustomed to the acronym fatca it stands for foreign account tax compliance act an ingenious american legislation to catch its citizens or dodging taxes by using accounts in other jurisdictions it will have major implications for jamaican financial institutions jamaican green card holders and dual citizens and thus jamaicaamp;#39;s finance minister peter phillips has asked the regulatory agents of the bank of jamaica to carry out a risk assessment of the banks and other financial institutions it regulates to determine their state of readiness fatca will not only impact on the banking sector and so on tuesday june 19 the financial services commission which regulates t