Flaws are present in every solution for editing every file type, and even though you can find a lot of solutions on the market, not all of them will fit your particular requirements. DocHub makes it much simpler than ever to make and change, and handle papers - and not just in PDF format.

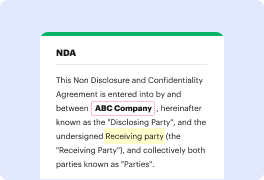

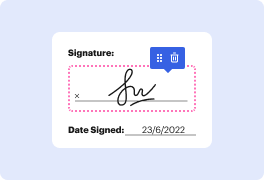

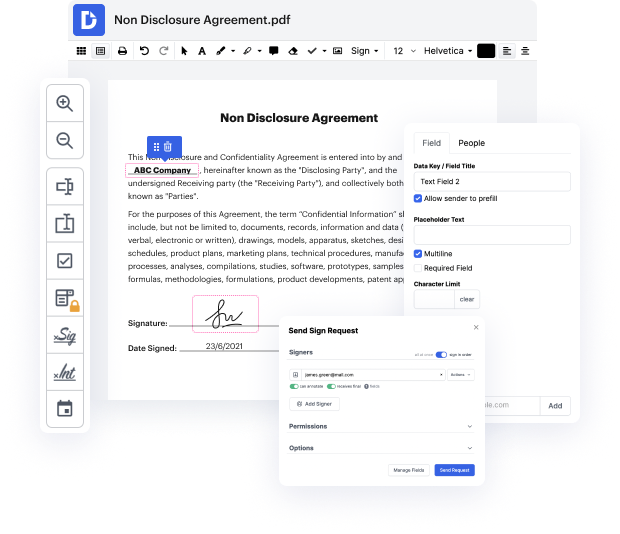

Every time you need to easily paste FATCA in CCF, DocHub has got you covered. You can quickly modify form components such as text and images, and structure. Personalize, arrange, and encrypt paperwork, build eSignature workflows, make fillable documents for intuitive information collection, etc. Our templates option enables you to generate templates based on papers with which you frequently work.

In addition, you can stay connected to your go-to productivity features and CRM solutions while managing your paperwork.

One of the most extraordinary things about utilizing DocHub is the ability to deal with form tasks of any difficulty, regardless of whether you need a swift edit or more diligent editing. It includes an all-in-one form editor, website form builder, and workflow-centered features. In addition, you can be certain that your papers will be legally binding and comply with all security protocols.

Shave some time off your tasks with DocHub's tools that make managing paperwork easy.

Welcome to our quick take on the foreign account tax compliance act or fatka the law thatamp;#39;s changed the game for international tax evasion passed in 2010 fatco requires foreign Banks to report on Americans overseas accounts hereamp;#39;s a deal fatco requires foreign Banks to identify us taxpayers with foreign Financial accounts Banks worldwide then must report those accounts to the IRS the IRS can then use that information to identify Americans hiding assets and income overseas itamp;#39;s all about transparency hiding money offshore is getting tougher whatamp;#39;s the result a Crackdown on tax Havens and billions unveiled in Hidden assets fatka has made life hard for international tax Havens and us taxpayers with assets overseas but thatamp;#39;s just part of the story stay tuned for the next piece of this financial puzzle