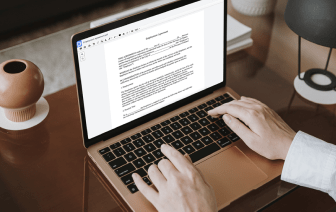

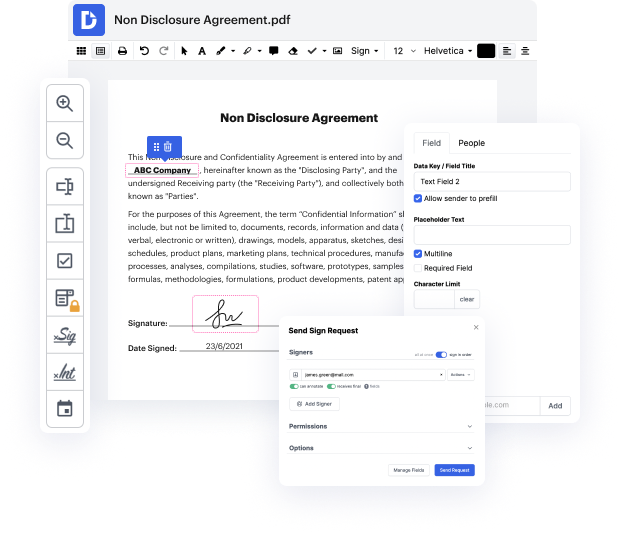

Many people find the process to modify FATCA in ACL quite challenging, especially if they don't often deal with documents. Nonetheless, nowadays, you no longer have to suffer through long tutorials or spend hours waiting for the editing software to install. DocHub lets you adjust forms on their web browser without installing new programs. What's more, our powerful service provides a complete set of tools for professional document management, unlike so many other online solutions. That’s right. You no longer have to donwload and re-upload your templates so often - you can do it all in one go!

Whatever type of document you need to modify, the process is straightforward. Make the most of our professional online solution with DocHub!

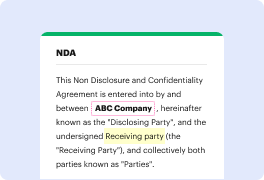

offshore accounts tax evasion and the might of the US government all elements of a very real Financial Thriller starting in 2009 the US set its sites on foreign financial institutions or ffis believed to Aid US citizens in hiding assets abroad this Crackdown immediately preceded FAA signaling the start of a no tolerance policy toward International tax Havens the Department of Justice alongside the IRS took aggressive action against ffis especially Swiss banks through high stakes criminal settlements these institutions paid Hefty fines and were compelled to reveal us account holders identities leading to billions in penalties and crucial data for the IRS the IRS then introduced programs allowing taxpayers to voluntarily report undisclosed foreign accounts those who ignor this Lifeline risked severe penalties and potential criminal charges as the us then implemented fatka the message seems to be clear offshore tax evasion has no place to hide