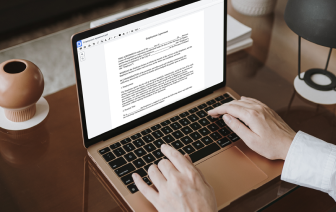

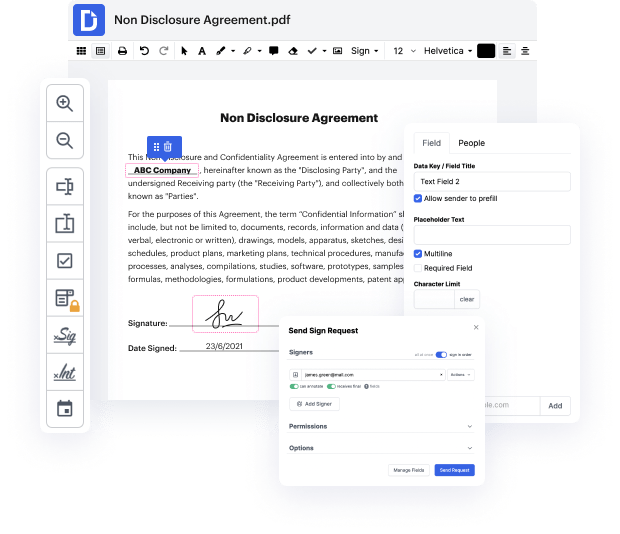

If you frequently work outside your workplace and carry out tasks on the go, then DocHub is the document editing service you need. It’s a cloud solution that operates on any internet-connected device, and you can work with it just about anywhere. The interface is intuitive yet rich, so you’ll need only a couple of moments to Modify design in Debt Settlement Agreement Template and make other required updates.

Stop wasting time trying to find an ideal document editor; try out DocHub now and complete your forms no matter where you are!

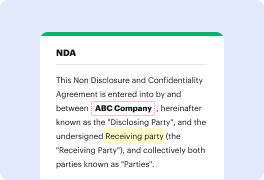

A debt settlement agreement is generally used to confirm a renegotiation or settlement of the original agreement between the debtor and the creditor. A debt settlement agreement usually reduces or eliminates the original amount of debt between the parties and allows the creditor to forgive part of the debt by releasing the debtor from any remaining obligation. Usually in exchange of the last payment made by the debtor to the creditor after the execution of the debt settlement a. The creditor should remove any obligation of the debtor under the original contract and renounced to pursue any auction against the debtor in relation to the original agreement.