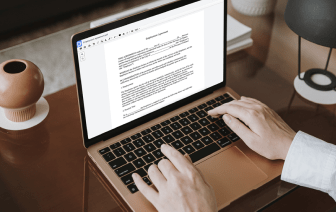

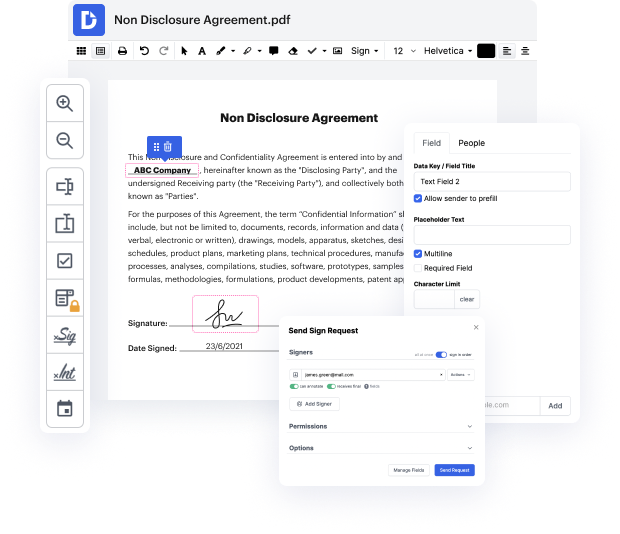

Having comprehensive power over your documents at any time is vital to alleviate your day-to-day duties and improve your productivity. Achieve any objective with DocHub tools for document management and hassle-free PDF editing. Gain access, modify and save and integrate your workflows along with other safe cloud storage.

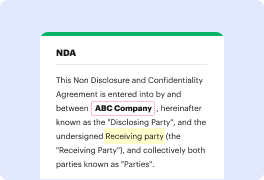

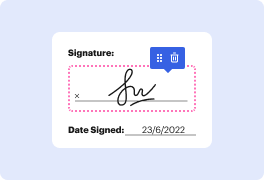

DocHub provides you with lossless editing, the opportunity to work with any format, and safely eSign documents without searching for a third-party eSignature option. Obtain the most from the document managing solutions in one place. Consider all DocHub features right now with the free of charge account.

In this video, the tutorial focuses on creating an amortization schedule for a mortgage or loan of $300,000 with a 30-year term and an annual interest rate of 5%, starting on July 1, 2020. It explains that the number of payments is calculated by multiplying the 30-year term by 12 months, totaling 360 monthly payments. The monthly interest rate is determined by dividing the annual rate by 12. To find the monthly mortgage payment, the video demonstrates the use of the PMT function in Excel, indicating that the rate used in this function corresponds to the calculated monthly rate.