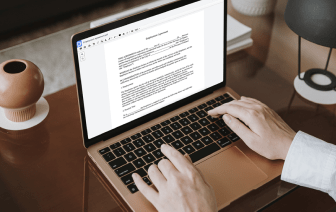

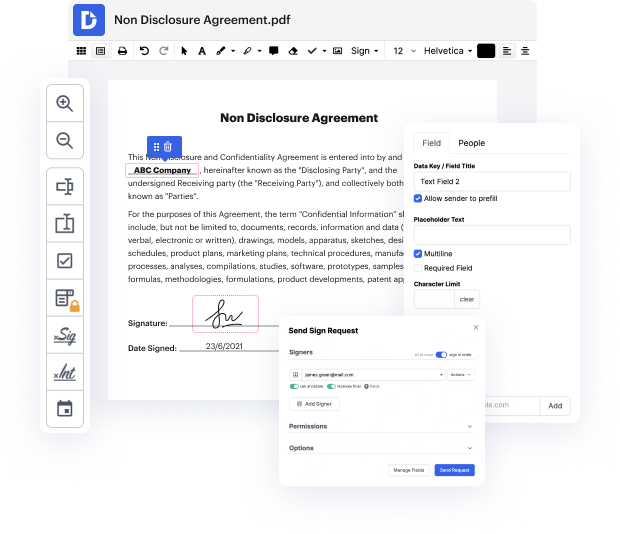

Working with papers like Bridge Loan Agreement may seem challenging, especially if you are working with this type the very first time. Sometimes even a little edit may create a major headache when you don’t know how to handle the formatting and steer clear of making a mess out of the process. When tasked to link account in Bridge Loan Agreement, you could always use an image modifying software. Other people might choose a conventional text editor but get stuck when asked to re-format. With DocHub, though, handling a Bridge Loan Agreement is not harder than modifying a file in any other format.

Try DocHub for fast and productive papers editing, regardless of the file format you might have on your hands or the kind of document you need to revise. This software solution is online, reachable from any browser with a stable internet connection. Modify your Bridge Loan Agreement right when you open it. We have developed the interface so that even users with no prior experience can easily do everything they need. Simplify your forms editing with a single sleek solution for just about any document type.

Dealing with different types of papers should not feel like rocket science. To optimize your papers editing time, you need a swift solution like DocHub. Manage more with all our instruments at your fingertips.

- The term bridge loan can cause some confusion when you're seeking private financing secured by real estate. The way you define a bridge loan may be totally different than how the lenders you encounter define the term. In this video, I'll clarify a few meanings of the term bridge loan with various loan scenarios, and I'll give you my suggestions for the proper terminology you should use when you're requesting a loan from a private lending company, which are also known as bridge lenders or hard money lenders. I'm Rocky Butani, Founder of PrivateLenderLink.com, where investors and brokers can easily find direct private lending companies. If you are in the investment real estate business and wanna gain insights into private mortgage lending, subscribe to our channel and get notified every time we release a new video. The confusion with the term bridge loan is more prevalent in the residential real estate space. In commercial real estate it's fairly easy to define. In fact, most of the p...