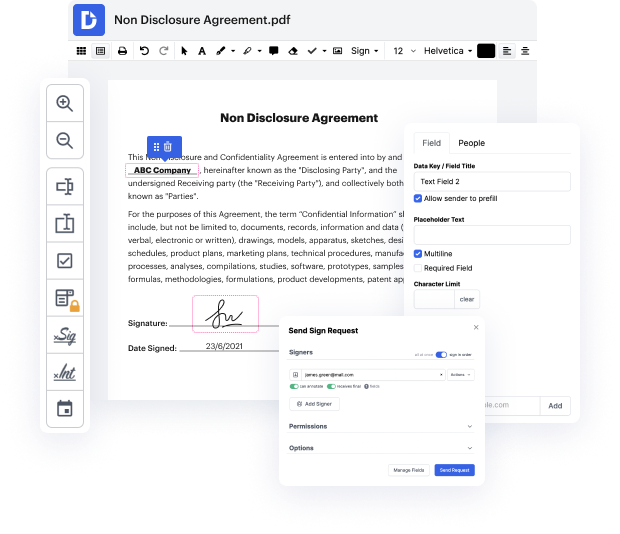

You realize you are using the proper file editor when such a basic task as Limit payment paper does not take more time than it should. Modifying files is now an integral part of many working processes in different professional areas, which explains why convenience and straightforwardness are crucial for editing tools. If you find yourself studying tutorials or trying to find tips on how to Limit payment paper, you may want to get a more intuitive solution to save time on theoretical learning. And here is where DocHub shines. No training is required. Just open the editor, which will guide you through its main functions and features.

A workflow gets smoother with DocHub. Use this instrument to complete the documents you need in short time and take your productivity to another level!

limitations section is part of a scientific study where its usually at the end of a scientific study and what you do if you think about the scientific method and the scientifics or research method what you should be doing is creating up you first read the literature come up with some sort of theory from that you develop some sort of hypothesis of how the world work works and then you go out and test those hypotheses you get some sort of results from that from those results you come up with some new understanding of the world and then you write that the limitations of your scientific study as well as a discussion of where you think that the study is going to go based on those results section the limitations section is usually kind of like a side note or most people treat them as a side note up here are all the different boundary conditions here are the things of how this study doesnt work and all the little different things of how the study doesnt work all the sort of possible assum

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more