Document editing comes as a part of numerous occupations and careers, which is the reason tools for it should be reachable and unambiguous in terms of their use. An advanced online editor can spare you a lot of headaches and save a considerable amount of time if you need to Limit equation lease.

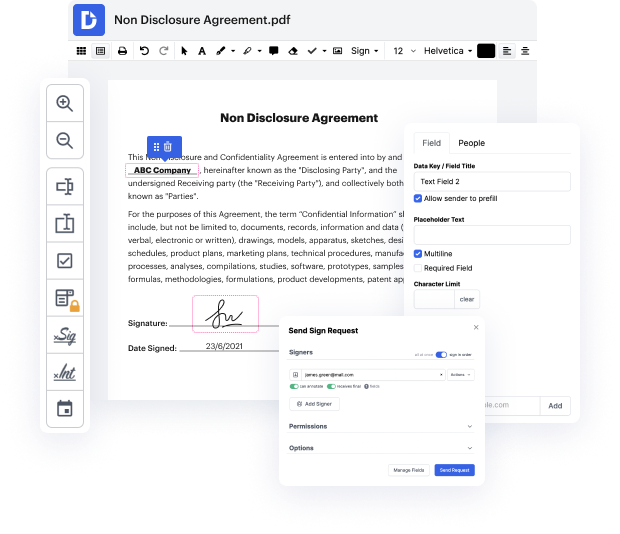

DocHub is an excellent demonstration of a tool you can master right away with all the useful features at hand. You can start editing immediately after creating an account. The user-friendly interface of the editor will help you to discover and employ any function right away. Experience the difference using the DocHub editor as soon as you open it to Limit equation lease.

Being an integral part of workflows, file editing should remain simple. Using DocHub, you can quickly find your way around the editor and make the desired changes to your document without a minute lost.

all right for this video i wanted to talk about what are the business tax deduction limitations for company vehicles that are leased through your business okay so you as a business owner you can lease vehicles through your business name tax id number address thats all okay you can lease them for yourself as an owner or employees but if you do so there are certain limitations on what amounts you might be able to deduct at the end of the year on your tax return and so thats what were going to go over in this video so theres really two limitations that could apply here the first one is the business versus personal use limitation right so when you when you use a vehicle for both business and personal uses you cant deduct the total cost of the lease payment right the piece of the deduction thats attributed to personal use is a non-deductible expense so for example if john is a business owner and he uses a vehicle 75 for business 25 for personal and his monthly lease payment is a thou

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more