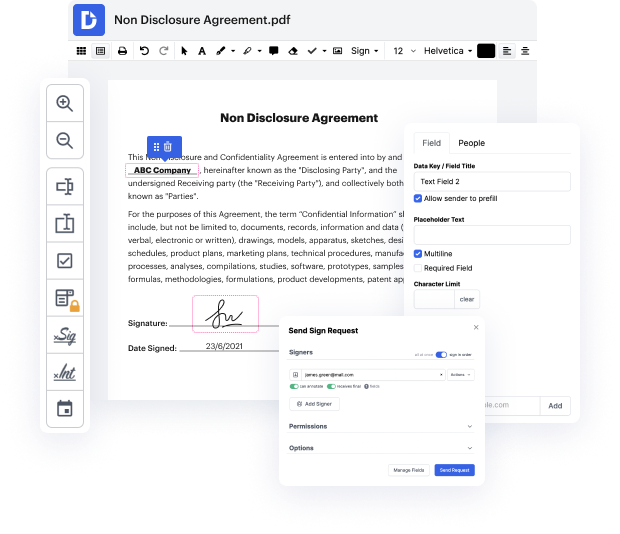

If you want to apply a small tweak to the document, it must not take long to Limit currency contract. This type of simple action does not have to demand additional training or running through manuals to learn it. Using the proper document editing tool, you will not take more time than is necessary for such a quick edit. Use DocHub to simplify your editing process regardless if you are an experienced user or if it is the first time making use of an online editor service. This instrument will require minutes or so to figure out how to Limit currency contract. The sole thing required to get more productive with editing is a DocHub profile.

A plain document editor like DocHub can help you optimize the amount of time you need to devote to document editing regardless of your prior knowledge about this kind of instruments. Make an account now and boost your efficiency immediately with DocHub!

in currency forward contracts underlined is obviously the currency rate or exchange rate to understand currency forwards you need to understand how the exchange rates are coated for example assume that you are an Australian and Australian dollar is your domestic currency and you want to trade Australian dollar against US dollar see if one u.s. dollar is equivalent to one point three Australian dollar then how they write the exchange rate they write the exchange rate in this manner they will put domestic currency in numerator and foreign currency in denominator aut 1.3 over USD this is domestic and this is foreign to make it simple to understand foreign currency is set at 1 and we see that how many Australian dollars we need to buy one foreign currency now see the exchange rate from the perspective of the currency forward contract so just like other contract this is one currency forward contract formed on 38 December one party is long another party is short expiry is six month 38 June

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more