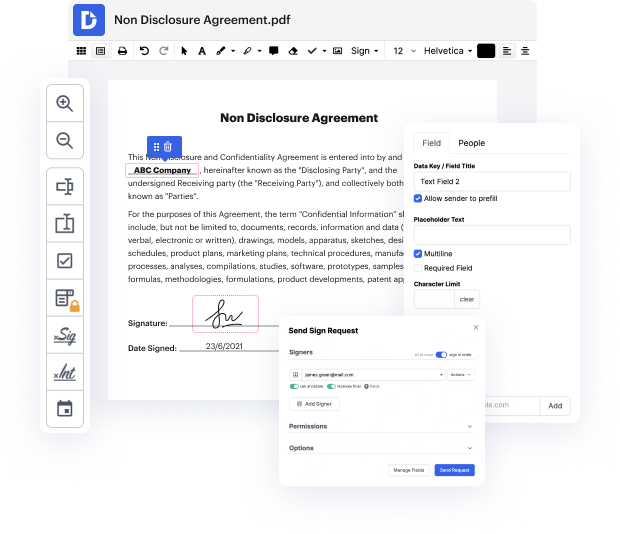

Do you want to avoid the challenges of editing Tax Agreement on the web? You don’t have to bother about installing untrustworthy solutions or compromising your documents ever again. With DocHub, you can join code in Tax Agreement without spending hours on it. And that’s not all; our easy-to-use solution also offers you powerful data collection tools for collecting signatures, information, and payments through fillable forms. You can build teams using our collaboration features and effectively interact with multiple people on documents. Best of all, DocHub keeps your data safe and in compliance with industry-leading security standards.

DocHub enables you to access its tools regardless of your system. You can use it from your notebook, mobile phone, or tablet and modify Tax Agreement easily. Begin working smarter today with DocHub!