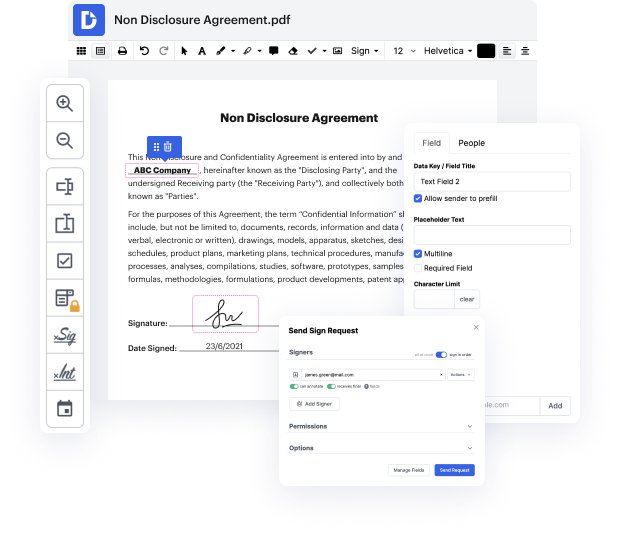

When you want to apply a minor tweak to the document, it must not take long to Itemize currency log. This kind of basic activity does not have to require additional training or running through guides to understand it. Using the right document editing resource, you will not spend more time than is needed for such a swift change. Use DocHub to simplify your editing process regardless if you are a skilled user or if it’s your first time making use of an online editor service. This instrument will take minutes to learn how to Itemize currency log. The only thing required to get more productive with editing is actually a DocHub account.

A simple document editor like DocHub can help you optimize the time you need to devote to document editing no matter your prior knowledge about this kind of tools. Make an account now and boost your efficiency immediately with DocHub!

So at the end of every month or every year, I have this to look forward to. Boxes and boxes of receipts. And Im going to show you a quick five-minute hack that helped me solve my receipt problem. Lets get to it. Hi, Im Mike Mancini, helping you market, simplify, and impact your business. So Im constantly out on the run. I might go and I might pick up a lunch and Id get a receipt. Or I go somewhere to meet a client and Ive got parking and I have receipts. And Ive got receipts for this and that and just absolutely everything. But the problem was is that I literally will take all of these receipts and I will throw them in a box and then when it comes tax season, I have to go through them all. Now on top of all of these receipts, I literally probably get five or six receipts a day into my email inbox so that a lot of the times, Ill have to print those out, put them in a book and deal with all of this. And then at the end of the year, I walk into my accountants office with folders