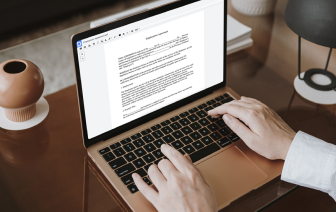

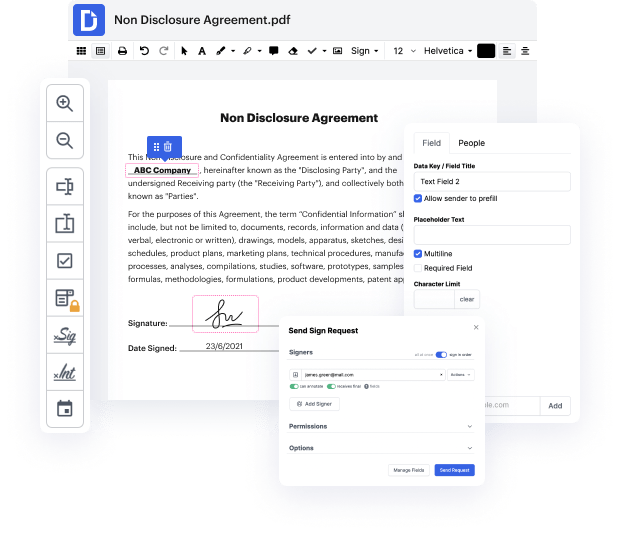

Time is an important resource that each company treasures and tries to change into a advantage. In choosing document management application, focus on a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge tools to optimize your document administration and transforms your PDF file editing into a matter of a single click. Insert Value Choice into the Mortgage Quote Request with DocHub in order to save a lot of efforts and increase your productiveness.

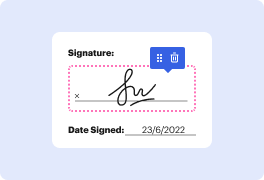

Make PDF file editing an simple and intuitive operation that helps save you a lot of valuable time. Easily adjust your files and give them for signing without the need of looking at third-party software. Focus on pertinent duties and improve your document administration with DocHub right now.

all right so this point youre familiar with the idea that you need to shop for a mortgage before you buy a home right you need to see which loan is going to be the cheapest but the hard part at this point is theres not a really good way to actually compare loans side by side from three different lenders five different lenders because they all have different upfront costs they have different rates they have different mortgage insurance and choosing the lowest rate isnt always the best option and so what you really want to understand is what is the full cost of that loan and up until now theres not really been a good way to transparently see all of the information about a loan and so ive created a tool thats going to do this where you can put in your own mortgage quotes or compare different sample scenarios like fha versus conventional and see which loan is going to be the best option for you depending on how long you think youre going to be in the home right if its going to be y