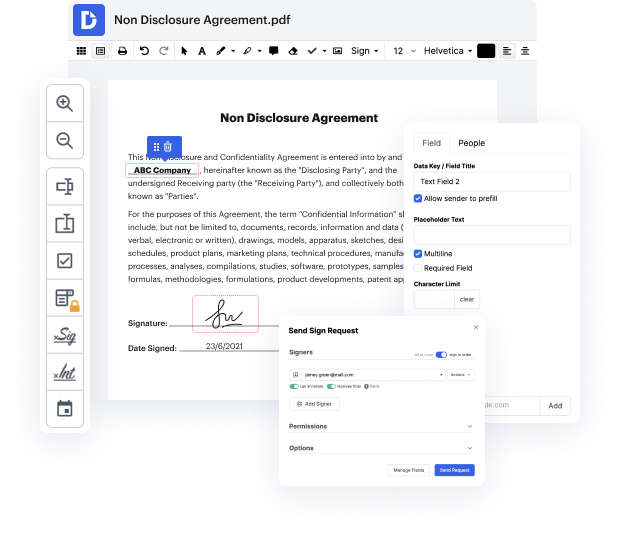

Time is a crucial resource that every enterprise treasures and tries to convert into a reward. When choosing document management software, be aware of a clutterless and user-friendly interface that empowers users. DocHub provides cutting-edge tools to optimize your file managing and transforms your PDF editing into a matter of one click. Insert US Currency Field into the Vat Invoice with DocHub in order to save a lot of time and enhance your efficiency.

Make PDF editing an simple and intuitive process that saves you a lot of precious time. Effortlessly modify your documents and send them for signing without the need of looking at third-party alternatives. Give attention to pertinent duties and increase your file managing with DocHub today.