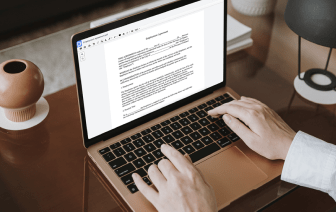

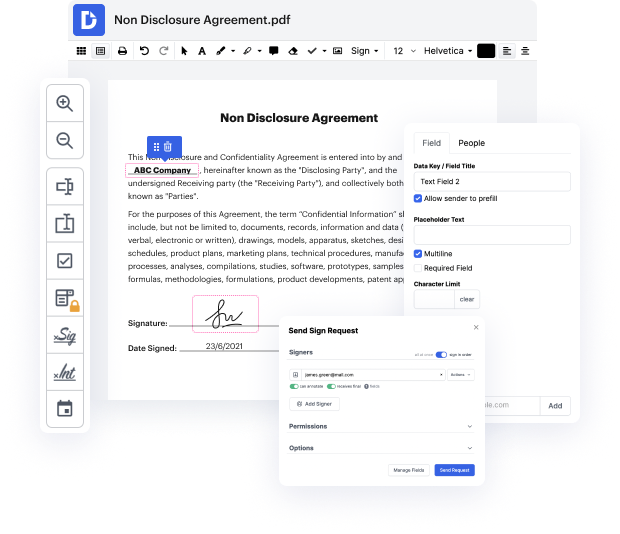

Time is a crucial resource that every company treasures and attempts to turn into a reward. When selecting document management software, focus on a clutterless and user-friendly interface that empowers users. DocHub provides cutting-edge instruments to improve your document administration and transforms your PDF file editing into a matter of a single click. Insert Text to the Demand For Extension Of Payment Date with DocHub to save a lot of time as well as enhance your productivity.

Make PDF file editing an simple and easy intuitive operation that helps save you a lot of valuable time. Quickly change your files and send out them for signing without switching to third-party solutions. Concentrate on pertinent tasks and enhance your document administration with DocHub today.

and today we are talking about tax day seven on your sides Michael Finney is here with me and on a normal year Michael wed be exactly one week away from the deadline right right but right for most of the people here in California taxes arent due for another six months but were still going to talk about it because theres so much to know there is and theres a lot of good reasons to file now oh okay well lets talk about that because right now we want to talk about the extension and what you need to know Larry Pond of pond and Associates joins us now thank you so much for being here we have a lot of questions for you Larry hello Karina Mike all right so first lets talk about that extension because you know so many people have questions about it uh Larry can you tell us who is impacted and what that extension just means overall right so normally taxes are due April 15th and thats been um the rule for for decades well April 15th is Saturday so then we go to the closest Monday which i