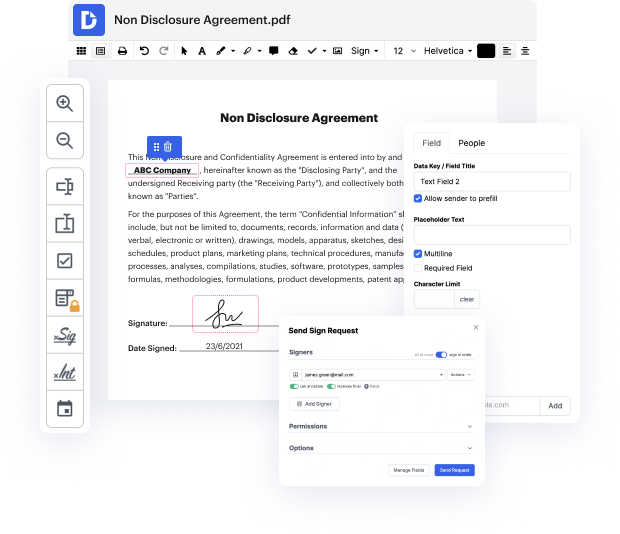

Time is a crucial resource that every business treasures and attempts to transform in a reward. When selecting document management software, take note of a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge features to optimize your file managing and transforms your PDF file editing into a matter of one click. Insert Surname Field from the Home Loan Application with DocHub in order to save a ton of time and improve your efficiency.

Make PDF file editing an simple and intuitive process that will save you a lot of valuable time. Quickly alter your documents and send them for signing without having turning to third-party alternatives. Give attention to relevant tasks and boost your file managing with DocHub starting today.

[Music] hey guys uh good afternoon angelo christian financial thank you so much for watching our podcast real estate insider i got a fun one for you today things that you should not tell your mortgage lender when youre getting a home loan and youre saying and youre going to wonder hey why is angelo saying theres things you should actually hide from your mortgage lender no im saying you know when youre getting a home loan you want to be very transparent you want to be honest you dont want to hide anything or be deceitful but obviously when youre buying real estate its a major transaction uh how many guys out there ever tried to buy a home before and youre really taken back or aside by all the questions that your loan officer is asking you know there are some things when youre getting a home loan that you dont want to disclose you dont want to discuss or actually do because you can actually jeopardize the transaction or affect yourself from getting approved for the home loan